Creating a receipt is a fundamental skill every business owner should master. Whether you’re a startup entrepreneur or an experienced business professional, the ability to produce legally compliant and professional receipts is a must. A receipt serves as a formal acknowledgment that a transaction has occurred between your business and your customer. This document is crucial for maintaining accurate financial records, ensuring customer satisfaction, and complying with legal requirements. In 2025, there are various methods available to help you create receipts, from traditional methods like receipt books to advanced digital tools like POS systems and invoicing software. Let’s explore the different methods and the essential components that every receipt must have to be effective.

The first step in creating a receipt is choosing the right method for your business. If your business handles a high volume of transactions, a point-of-sale (POS) system is typically the most efficient and professional solution. POS systems can automatically generate receipts with all the required details, such as transaction amounts, taxes, and reference numbers, making it easy for you to stay organized. However, if you’re running a smaller operation or only deal with occasional cash transactions, investing in a POS system might not be cost-effective. In such cases, creating your own receipts using a template is an excellent alternative. You can design your own receipt in programs like Microsoft Excel, Google Sheets, or even Word. Many online resources offer free templates that can simplify this process, though it’s important to ensure that all mandatory details are included in the receipt template.

If you prefer a physical option, you can also use a receipt book. A receipt book typically includes pre printed reference numbers that help streamline the process of issuing receipts manually. Although this is a low-cost option, it can be time-consuming and prone to human error. In this case, you must also manually input transaction details into your accounting system, which could lead to inconsistencies in your records.

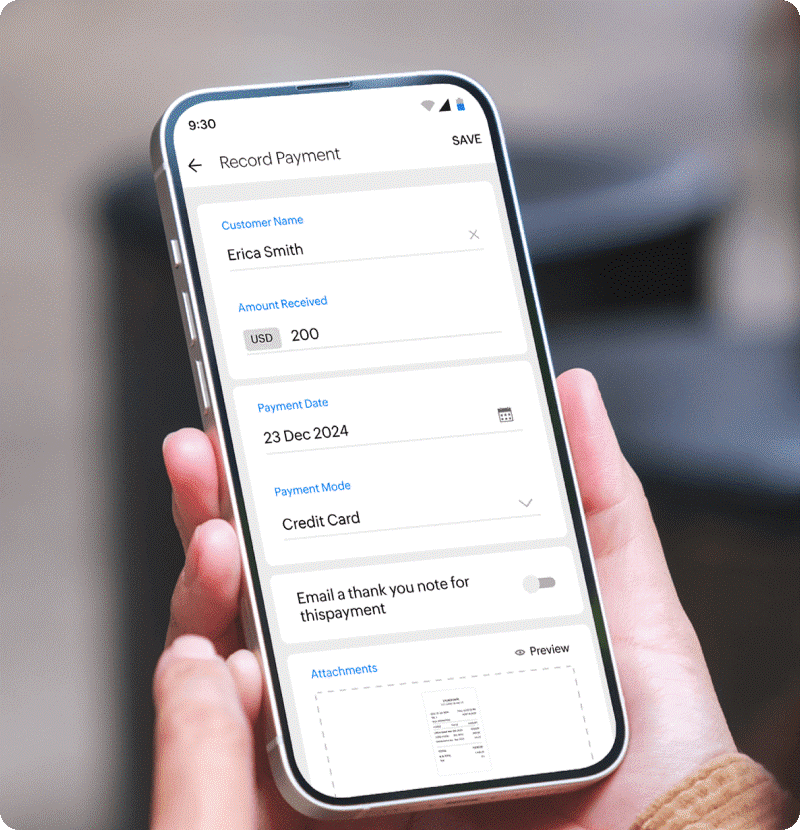

Another option for creating receipts is using invoicing software to generate cash invoices. Cash invoices act as proof that a sale has occurred and payment has been received. These invoices can easily be generated in software, reducing human error and saving time. Many invoicing tools allow you to create professional receipts, export sales records, and even integrate directly with your accounting system for seamless financial management.

Regardless of the method you choose, there are six crucial elements that every receipt must contain to ensure it is both professional and legally compliant. The first component is the name and organization number of your business. This ensures that the receipt can be linked to your business in case of any disputes or for tax purposes. Next, the receipt must provide a description of the goods or services sold. It’s essential to list the items or services clearly and include quantities and prices to avoid confusion. The location of the sale or delivery is also required, as this helps establish where the transaction occurred, which is important for tax compliance. Additionally, the receipt should display the total price of the transaction, including taxes like VAT or GST, if applicable. The tax rate and the tax amount must also be clearly stated. Lastly, every receipt should have a unique reference number, which is vital for tracking and organizing transactions.

Beyond the basic information, receipts may also include additional details such as the customer’s contact information or your return and refund policies. While this isn’t legally required in all regions, including these details can improve customer satisfaction and provide clarity on your business policies. Having a structured receipt template helps your business stay organized and ensures that you meet local tax laws and accounting standards.

In summary, creating receipts in 2025 is simpler than ever, with various methods available depending on the scale of your business. Whether you choose a POS system, a receipt book, or digital invoicing software, the key is to include all necessary information and ensure that the receipt is clear, accurate, and legally compliant. By mastering the art of creating receipts, you not only enhance your business operations but also build trust with your customers, ensuring smooth transactions and financial transparency.

What is a Receipt?

A receipt is a fundamental document that serves as a tangible record of a financial transaction. It is issued by a business or seller to a customer as proof that a product or service has been purchased. While the concept of a receipt may seem straightforward, its importance goes beyond simply confirming payment. A receipt plays a critical role in a range of activities, from maintaining accurate financial records to ensuring consumer protection. It provides transparency and helps in various legal, accounting, and customer service processes.

The most obvious role of a receipt is to serve as evidence that a transaction has been completed. When a customer makes a purchase, whether it’s a product, a service, or a combination of both, the receipt confirms that the customer has paid for the goods or services provided. This proof of purchase is essential for several reasons. First, it acts as a safeguard for customers, allowing them to demonstrate that they have bought an item in case they need to return or exchange it. Second, it protects businesses from potential disputes, ensuring that both parties agree on the details of the transaction.

Beyond serving as proof of purchase, receipts are also crucial for warranty claims. Many products come with warranties that are valid only when a valid receipt is presented. This makes the receipt a key document for consumers who need to make claims for repairs, replacements, or service under the terms of the warranty. In the case of a faulty product, having the receipt ensures that the customer can easily prove the date of purchase, which is often necessary for making claims.

From an accounting perspective, receipts are indispensable tools for both individuals and businesses. For customers, keeping receipts is a good practice for managing personal finances. A receipt helps in tracking purchases and organizing expenses, which can be useful for budgeting or preparing tax returns. On the business side, receipts are vital for maintaining accurate financial records. Companies rely on receipts to record sales and expenses, calculate profit margins, and prepare for audits. Without proper receipts, businesses may face difficulties in tracking their financial performance or facing legal compliance issues.

In addition to providing documentation for transactions, receipts often include important details such as the name and contact information of the business, the date and time of the transaction, the items purchased, the amounts charged, and any applicable taxes. These details make receipts comprehensive records that businesses can use for invoicing and accounting purposes. They may also include terms and conditions, return policies, or disclaimers, which help inform customers about their rights and responsibilities.

For tax purposes, receipts play an essential role in supporting tax filings. Both businesses and consumers rely on accurate receipt records to demonstrate the payment of goods and services, especially when value-added tax (VAT) or sales tax is involved. In some jurisdictions, businesses are legally required to issue receipts for every transaction, and failing to do so may lead to fines or penalties. Additionally, receipts are a crucial tool for businesses in managing their accounts receivable and accounts payable, ensuring that payments are properly tracked and accounted for.

In today’s digital world, receipts are increasingly being issued electronically, especially for online transactions. E-receipts are convenient for both customers and businesses, as they reduce paper waste and allow for quick access to transaction records. Many businesses now offer customers the option of receiving digital receipts via email or through apps, which makes it easier for consumers to manage and store their receipts.

In conclusion, a receipt is much more than a simple piece of paper. It is a vital document that serves a range of functions, including proving purchase, supporting warranty claims, maintaining financial records, and ensuring compliance with tax regulations. Whether physical or digital, receipts are essential for both consumers and businesses to safeguard their interests, manage finances, and ensure a smooth transaction process. Understanding the importance of receipts and how they work is crucial for anyone involved in buying or selling goods and services.

How to Create a Receipt

There are several ways to create receipts. Most businesses use a Point of Sale (POS) system, which can automatically generate receipts for transactions. However, if you don’t have a POS system, there are other options you can explore.

1. Build Your Own Template

Building your own receipt template is an efficient and cost-effective solution for businesses that need to create receipts regularly but may not want to invest in expensive software or complex point-of-sale (POS) systems. By using tools like Google Docs, Microsoft Excel, or Word, you can create a personalized template that matches your business needs, offering flexibility and full control over the receipt’s design and layout. This method is particularly beneficial for small businesses, freelancers, or service-based professionals who deal with relatively low transaction volumes or need a simple way to issue receipts.

One of the most significant advantages of building your own receipt template is the control it provides over the presentation and content. You can tailor the layout to suit your branding, ensuring that your receipts reflect your business’s identity, whether through the inclusion of logos, color schemes, or fonts that match your overall aesthetic. The flexibility of these tools also means that you can easily customize sections to include additional details specific to your business needs, such as return policies, contact information, or tax rates.

Additionally, there are numerous free and paid templates available online that can help you get started quickly. These templates are often pre-formatted with essential receipt maker components, like item descriptions, prices, and total amounts. You can download one of these templates and modify it to fit your business’s unique requirements. This can save you a significant amount of time compared to building a template from scratch, especially if you’re not experienced in design or document formatting.

However, while building your own template offers numerous benefits, there are a few important considerations and drawbacks to keep in mind. The most significant issue is the potential for human error. Because you’ll be manually entering information for each receipt, it’s easy to overlook important details, such as the correct reference number or tax calculations. This can lead to inconsistencies and confusion for both you and your customers. Without automated systems in place to handle these details, the risk of mistakes increases, particularly during busy periods or when you’re working with numerous transactions.

Another potential drawback is the legal requirements regarding receipts in some jurisdictions. In many countries, businesses are required to issue receipts that include specific information, such as a unique reference number, tax identification numbers, or the use of certified receipt books or software to comply with tax regulations. Manually issued receipts, especially those created without a standardized reference number system, may not meet these requirements. This could result in issues with compliance, particularly during audits or legal proceedings. Therefore, it’s crucial to check the regulations in your area before deciding to use a homemade receipt template.

For businesses operating in regions with strict tax reporting standards, such as those requiring VAT or GST records, ensuring that your receipts meet local legal guidelines is essential. In some cases, manual receipt generation may not satisfy the documentation requirements necessary for tax reporting or accounting purposes. Depending on your country’s regulations, you may need to integrate your receipt template with other software or systems to ensure that taxes are properly tracked, or that your receipts are sufficiently detailed for tax authorities.

In cases where you are unsure of the legal requirements for issuing receipts, consulting with a legal expert or accountant can help you avoid potential pitfalls. They can guide you on how to design your receipt templates in a way that complies with tax laws while still maintaining the flexibility and customizability that you want for your business.

In summary, building your own receipt template is an excellent option for small businesses, freelancers, or service-based professionals looking for a simple and cost-effective way to generate receipts. While this approach offers complete control over design and content, it does come with risks related to human error and legal compliance. It’s essential to carefully review the regulations in your area before proceeding with manual receipt creation. If you find that manual methods are not sufficient for your business needs, consider integrating software that can automate and streamline the process, ensuring accuracy and legal compliance while still maintaining the flexibility you need to run your business efficiently.

2. Use a Receipt Book

Using a receipt book is a straightforward and cost-effective alternative to digital systems, especially for small businesses or those who don’t have access to a point-of-sale (POS) system. A receipt book typically comes with pre printed reference numbers, providing an organized way to issue receipts without the need for creating each one from scratch. This system is popular among small shops, service providers, and freelancers who may have limited budgets for digital tools but still need a reliable method for recording sales transactions.

One of the main advantages of using a receipt book is its simplicity. It is a tangible, paper-based solution that requires minimal setup. Whether you’re dealing with cash transactions or need to issue receipts for services rendered, receipt books allow you to quickly provide customers with proof of purchase. This can be especially useful for businesses that operate on a smaller scale or for those just starting out, as it doesn’t require any complex equipment or technology. Furthermore, receipt books are affordable and readily available at most office supply stores, making them a low-cost option for business owners.

Another benefit of using a receipt book is that it’s portable and easy to use in a variety of environments. For businesses on the go, such as market vendors or mobile service providers, a receipt book can be taken anywhere and used without the need for power sources or internet connections. This flexibility makes it an attractive choice for businesses that operate outside of a traditional office or storefront setting. Additionally, the preprinted reference numbers on each receipt help maintain organization, making it easier to track transactions and stay on top of record-keeping.

However, there are notable drawbacks to using a receipt book. The primary disadvantage is that it is more time-consuming compared to digital methods. Each receipt must be filled out manually, requiring you to record information such as the customer’s name, the items or services purchased, the price, and any applicable taxes. This can become a tedious process if your business experiences a high volume of transactions, especially during peak periods. Moreover, if you’re issuing several receipts in a day, the manual process can lead to errors, such as miswritten information or missed details, which can cause confusion or disputes with customers.

Additionally, after each transaction, you must manually enter the information from the receipt into your accounting system. This extra step can significantly increase administrative work and take time away from other important tasks. If you’re not organized, keeping track of receipts and ensuring that they match your accounting records can become difficult, leading to potential discrepancies in your financial reports. Since receipt books are paper-based, there is also a risk of losing or damaging receipts, which could create problems for future reference or during audits.

Another limitation is that while receipt books are easy to use, they may not comply with legal requirements in some jurisdictions. Many countries have specific regulations for sales receipts, such as the inclusion of tax information, unique reference numbers, or digital storage of receipts for tax purposes. Manually issued receipts may not meet these legal standards, which could result in fines or issues with tax authorities if not properly recorded. For businesses that are subject to frequent audits or operate in heavily regulated industries, using a receipt book might not provide the level of documentation required for compliance.

To mitigate these drawbacks, businesses that rely on receipt books should ensure they maintain accurate records and regularly update their accounting systems to reflect all issued receipts. In some cases, integrating receipt books with a digital system—such as scanning receipts or manually entering data into accounting software—can help streamline the process and reduce human error.

In conclusion, while using a receipt book offers an affordable and easy alternative for generating receipts, it does come with its challenges. The time-consuming nature of manually issuing receipts and entering data into your accounting system can lead to extra administrative burdens and potential errors. Moreover, businesses must be mindful of the legal requirements in their region, as paper receipts may not always meet compliance standards. For smaller operations or those in need of a simple solution, a receipt book can be a valuable tool, but it’s essential to consider upgrading to a digital system as your business grows to improve efficiency and accuracy.

3. Create a Cash Invoice

A cash invoice is an essential document for businesses that frequently deal with cash transactions. This type of invoice acts as proof that a sale has been made and that the payment has been received in cash. A cash invoice is important for both the business and the customer, providing clear documentation of the transaction. For businesses that handle cash payments, issuing a proper invoice is crucial for maintaining accurate records, ensuring legal compliance, and managing financial transparency.

The main advantage of using a cash invoice is that it streamlines the process of recording cash transactions. When a customer pays in cash, the business needs to document the sale and the corresponding payment. A cash invoice serves as a receipt that not only confirms the payment but also includes all relevant transaction details such as the items purchased, the total cost, taxes, and the date of the transaction. This is especially important for small businesses and service providers who rely heavily on cash payments.

One of the most significant benefits of using invoicing software to generate cash invoices is efficiency. Invoicing software automates the creation of invoices, which significantly reduces the time and effort spent on manual processes. When you input the transaction details, the software can automatically calculate taxes, apply discounts, and generate a professional invoice for the customer. This eliminates the possibility of human error, ensuring that the amounts on the invoice are accurate and aligned with the transaction. Additionally, invoicing software can also integrate with your accounting system, making it easier to manage sales records and financial data. This integration reduces the risk of mistakes that could occur when manually transferring data between different systems or spreadsheets.

In addition to accuracy, invoicing software provides the added advantage of creating professional, consistent invoices. Many software solutions offer customizable templates that you can tailor to your business’s branding. This means that every invoice you send will have a uniform look, including your business logo, color scheme, and contact information. This not only enhances the professionalism of your business but also helps you maintain a consistent brand image.

Another benefit of using invoicing software is that it helps with organization and tracking. Many invoicing systems allow you to store invoices in an easily accessible database, enabling you to quickly search for past transactions. This is especially useful when you need to reference a particular sale or provide a customer with a copy of a previous invoice. Some software even includes features like invoice tracking, which lets you monitor the payment status and send reminders for overdue payments, ensuring that you stay on top of outstanding balances.

Despite the many advantages of invoicing software, it is important to consider the associated costs. Many invoicing solutions charge a monthly or annual fee, which can add up over time. While this investment can provide significant benefits in terms of time savings, accuracy, and organization, small businesses or startups with limited budgets may find the cost prohibitive. However, the value of the time saved, the professional appearance of your invoices, and the reduction in errors often outweigh the cost of the software.

For businesses just starting out or those with fewer transactions, there are free or low-cost invoicing software options available that provide essential features such as customizable templates, automatic calculations, and simple record-keeping tools. These options can offer an affordable entry point for small businesses, allowing them to generate cash invoices without the overhead of expensive software.

In conclusion, using invoicing software to create cash invoices is an efficient and effective solution for businesses that handle cash transactions. The automation of the invoicing process reduces the time spent on administrative tasks, minimizes the risk of errors, and ensures professional, accurate invoices. While the cost of invoicing software can be a consideration, many small businesses find that the benefits it provides in terms of time savings, accuracy, and organization make it a worthwhile investment. As your business grows, integrating invoicing software into your operations can help streamline your processes and improve financial management.

Is Cash Invoicing the Same as a Sales Invoice?

Cash invoicing and sales invoicing are two types of invoices that are often misunderstood or used interchangeably, but they serve different purposes in the transaction process. Both play crucial roles in documenting financial transactions, but their usage and context are distinct. Understanding the difference between these two types of invoices can help businesses maintain proper financial records and ensure smooth operations, especially when managing different payment methods.

A sales invoice is typically issued after goods or services have been provided but before payment has been received. Its primary purpose is to request payment from the customer. This type of invoice outlines the amount due, details about the purchased goods or services, payment terms, and the deadline by which the payment should be made. It may also include information such as the customer’s billing address, the seller’s contact information, and any applicable taxes or discounts. Sales invoices are commonly used in credit sales, where the customer is expected to pay the specified amount at a later date. The payment terms on a sales invoice are crucial as they specify the agreed-upon time frame for settling the balance, which may be immediate, within a few days, or over a more extended period depending on the agreement between the seller and the buyer.

On the other hand, a cash invoice is issued at the point of sale when the customer has already made a cash payment. This type of invoice serves as immediate proof of purchase and payment. It confirms that the transaction has been completed, and the customer has paid in full at the time of purchase. A cash invoice usually includes the same types of details as a sales invoice, such as a description of the goods or services, the total cost, taxes, and any applicable discounts. However, the key distinction is that a cash invoice specifically records that payment has been made in cash, and no further payment is due. Unlike a sales invoice, there is no expectation of future payment, as the transaction has already been settled.

The importance of a cash invoice lies in its role as both a receipt and an invoice. Since the payment is made immediately, the cash invoice serves as proof that the customer has completed the transaction in full. For businesses, this means that no outstanding balance remains, and they can immediately proceed with other sales or services. For customers, the cash invoice acts as documentation that their payment has been received, which can be useful for their personal records, for returns or exchanges, or in case they need to make a warranty claim.

The distinction between cash invoices and sales invoices also extends to accounting practices. For a business, a sales invoice represents accounts receivable, as it reflects money that is expected to be paid in the future. In contrast, a cash invoice is considered a completed transaction, and the payment is immediately reflected in the business’s cash flow. This difference is important for accurate bookkeeping and financial reporting. When issuing a cash invoice, businesses can immediately record the payment in their accounting system, reducing the need to track outstanding balances or follow up on overdue payments.

In some cases, businesses may issue both a sales invoice and a cash invoice for the same transaction. For example, if a customer makes a partial payment in cash and agrees to pay the remaining balance at a later date, the business may issue a cash invoice for the amount received and a sales invoice for the remaining balance. This approach helps keep records clear and ensures that all payments are properly documented.

In summary, while both a cash invoice and a sales invoice are important documents in the transaction process, they are used in different scenarios. A sales invoice is typically issued when goods or services are provided on credit, and payment is expected in the future, while a cash invoice is issued immediately upon receipt of cash payment, serving as proof of the completed transaction. Understanding the differences between these two types of invoices ensures that businesses can manage their finances effectively and maintain accurate records for both accounting and tax purposes.

What Information Should Be Included on a Receipt?

Once you’ve decided how to create your receipts, you need to ensure that they include all necessary details. Here are the six key elements that must be on every receipt:

- Business Name and Organization Number: The official name and registration number of your business.

- Description of Goods or Services: A clear description of what was sold, including quantity and pricing.

- Location of the Sale: This indicates where the goods or services were sold or delivered.

- Price: The amount paid for the goods or services.

- Value-Added Tax (VAT) or Goods and Services Tax (GST): If applicable, the tax rate and the tax amount should be displayed.

- Receipt Number: A unique reference number for each receipt to track transactions.

Additionally, for tax and accounting purposes, you may want to include other information, such as the buyer’s name and address, along with your company’s return and refund policy.

Making a Receipt: Putting It All Together

When it comes to creating a receipt, the most effective and professional method is to use a point-of-sale (POS) system. A POS system can streamline the process by automatically generating receipts that include all the necessary transaction details, such as item descriptions, prices, taxes, and reference numbers. This approach saves time, minimizes the risk of human error, and ensures that your receipts are standardized, making them easier to track and manage. POS systems also integrate directly with your accounting software, reducing the need for manual data entry and making it easier to reconcile sales figures and manage inventory. For businesses with high volumes of transactions, investing in a POS system is often the best solution to keep operations efficient and compliant with tax regulations.

However, for small businesses or those with infrequent cash transactions, a POS system may not be the most cost-effective option. In these cases, creating your own receipt templates or using a receipt book can be practical alternatives. Custom receipt templates can be created using tools such as Google Docs, Microsoft Excel, or Word. This method offers flexibility in design and layout, allowing you to incorporate your business’s branding, include your contact information, and specify terms such as return policies or warranties. Templates can be saved and reused for each transaction, ensuring consistency across receipts. However, while this method is cost-effective, it does require manual input, which increases the risk of errors. Additionally, you will need to ensure that the receipts you create comply with local regulations, as some regions require digital receipts or specific formatting for tax purposes.

For businesses that prefer to use a more traditional method, receipt books can be a good solution. Receipt books typically contain preprinted reference numbers, which help maintain organization and ensure that each receipt is unique. They are ideal for businesses that handle low transaction volumes or operate in environments where electronic systems are not feasible. While receipt books are an affordable and simple option, they come with their own set of drawbacks. For one, they require manual entry of transaction details, which can be time-consuming and prone to human error. Additionally, all information needs to be recorded separately in the accounting system, adding to administrative workload and increasing the risk of discrepancies.

In cases where you are dealing with cash transactions, cash invoices are another important tool. A cash invoice serves as proof that a sale has been completed and that payment has been made. It is issued immediately after payment is received and can be used as both a receipt and an invoice, ensuring that the transaction is fully documented. Cash invoices are particularly useful for businesses that operate on a cash-only basis or for customers who prefer paying in cash. When generating a cash invoice, it’s crucial to include essential information such as the itemized list of goods or services, the total cost, applicable taxes, and the unique reference number. Using invoicing software to create cash invoices can save time and ensure accuracy, as the software can automatically populate the necessary fields and integrate with your accounting system.

Regardless of the method you choose for creating receipts, the key is to ensure that all required information is included. This typically includes the business name and contact information, a description of the items or services sold, the total amount paid, any applicable taxes, and a unique reference number for tracking. In addition, if your business is subject to specific tax regulations, such as VAT or GST, the receipt must include the appropriate tax details to comply with local laws. Furthermore, it’s important to maintain accurate records for both your business and your customers. Well-organized receipts help protect your business during audits and disputes, and they also make it easier for customers to track their purchases, manage warranties, or return items if necessary.

To summarize, creating a receipt in 2025 involves selecting the most appropriate method for your business needs, whether through a POS system, receipt templates, or a receipt book. Each option has its own set of advantages and drawbacks, so it’s essential to weigh factors like transaction volume, cost, and compliance with legal requirements. No matter the method, the most important aspect is ensuring that all necessary transaction details are recorded accurately and consistently. By doing so, you’ll help maintain clear financial records, avoid errors, and stay compliant with tax regulations, while also providing your customers with a reliable proof of purchase.

Conclusion

In conclusion, the process of creating a receipt is a vital aspect of any business, ensuring both legal compliance and smooth financial operations. Whether you choose to use a POS system, create your own templates, or rely on a traditional receipt book, the key is to ensure that all essential transaction details are included accurately. A POS system is ideal for high-volume businesses due to its efficiency and integration with accounting software, while smaller businesses or those with fewer cash transactions may find receipt templates or receipt books more practical and cost-effective. Additionally, cash invoices provide clear documentation for cash transactions, helping businesses keep organized and compliant. Whatever method you choose, it’s essential to maintain accurate and consistent records, as they protect both your business and your customers, ensuring transparency and compliance with tax regulations. By understanding the best options available and the requirements for your specific business, you can create a receipt system that enhances operational efficiency, reduces errors, and fosters trust with your customers.