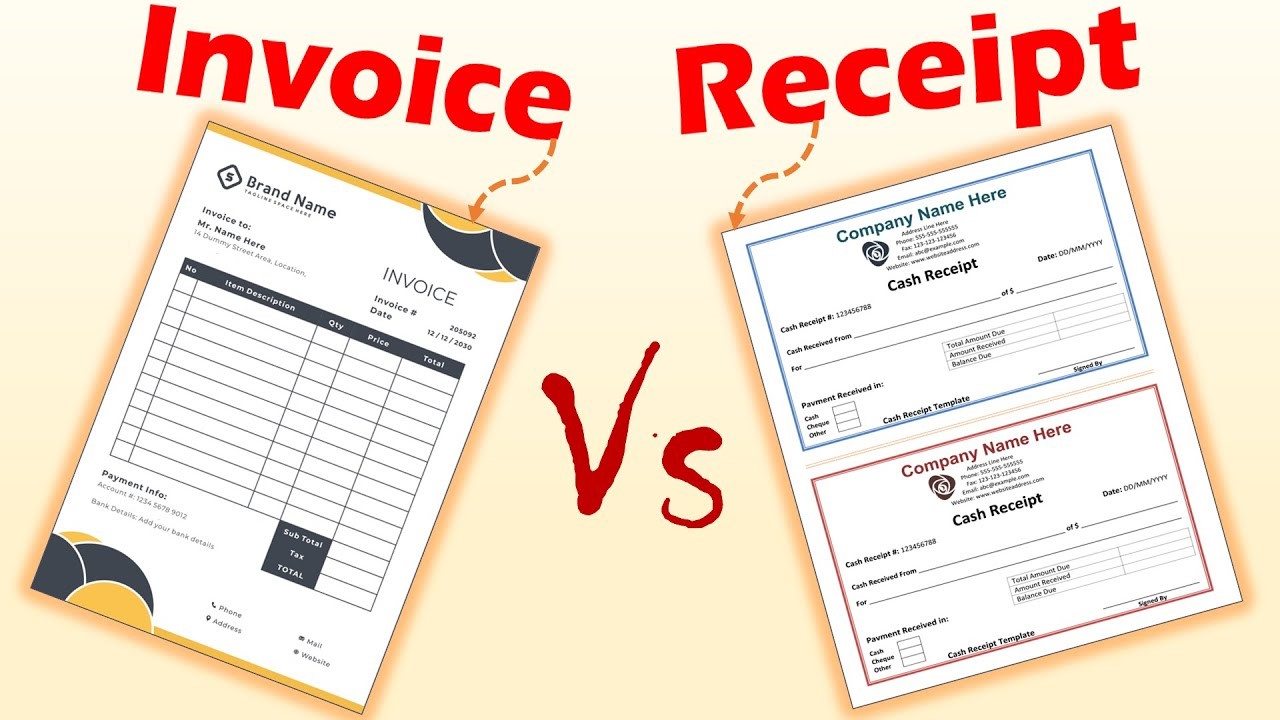

Invoices and receipts are integral components of financial transactions, providing both businesses and customers with essential documentation. While they may seem similar at first glance, they serve distinct purposes and play different roles in the payment process. These two documents are vital for maintaining accurate financial records, ensuring proper tax reporting, and facilitating smooth business operations.

An invoice is typically issued by a seller to a buyer before payment has been made. It serves as a request for payment, outlining the details of the goods or services provided, the quantities, the agreed-upon prices, and any applicable taxes or discounts. The invoice establishes a formal record of the transaction and the buyer’s obligation to pay within a specified timeframe. For example, a small business owner may issue an invoice to a client for a set of services completed, with payment due within 30 days. This document functions as a reminder to the buyer that payment is expected and helps both parties track the details of the transaction.

Invoices are essential for businesses because they provide clear documentation of outstanding payments, allowing sellers to manage accounts receivable and track revenue over time. Additionally, invoices are critical for tax compliance, as they provide a detailed record of taxable transactions, which can be used for accurate reporting of sales tax or VAT. Invoices can also be legally binding if a dispute arises, ensuring that both the seller and buyer are held accountable for the agreed-upon terms.

On the other hand, a receipt is issued after payment has been made. It serves as proof of payment and provides a confirmation that the transaction has been completed. A receipt typically includes the amount paid, the method of payment, the date of the transaction, and a description of the goods or services purchased. For example, after paying for an item at a retail store, the customer receives a receipt, confirming that the amount has been paid and that the transaction is complete.

Receipts are just as crucial for businesses as invoices, as they provide proof that the payment has been received and ensure that financial records are accurate. For customers, receipts serve as important documentation for returns, refunds, and warranty claims. A receipt can also be used for expense tracking, tax deductions, or even as proof of purchase when filing insurance claims or returns. They help businesses manage cash flow by providing a record of incoming payments and can serve as a reference for resolving any issues related to the transaction.

While invoices and receipts serve different purposes, they are complementary in the financial process. Invoices initiate the payment process by formally requesting payment, while receipts finalize the transaction by confirming that payment has been made. Both documents are critical for maintaining transparency between businesses and customers, helping to build trust and ensure smooth business operations.

Creating these documents has become much easier thanks to digital tools such as an invoice generator and receipt maker. These tools allow businesses to create professional invoices and receipts quickly and efficiently, with built-in templates that ensure all necessary information is included. An invoice generator can automatically calculate totals, taxes, and discounts, while a receipt maker can easily create a receipt after payment has been received. These tools are especially useful for small businesses or freelancers, who may not have the resources to manage invoicing and receipts manually.

In conclusion, while invoices and receipts are often used interchangeably, they serve distinct functions within the payment process. Invoices are used to request payment, while receipts are issued as proof of payment. By understanding the differences between these two documents, businesses can ensure that their financial records are well-maintained, transparent, and compliant with tax regulations. Leveraging modern tools like invoice generators and receipt makers can streamline the process, saving time and reducing errors. Whether you are a small business owner or a freelancer, having a clear understanding of invoices and receipts, and using the right tools, is essential for maintaining organized and efficient financial systems.

Understanding the Difference Between an Invoice and a Receipt

An invoice and a receipt are both crucial documents in the world of business, each serving a distinct role in the financial transaction process. While they are closely related, they differ significantly in terms of when they are issued and their purpose. Understanding these differences can help ensure smoother operations for both businesses and customers.

An invoice is issued by the seller before payment is received. It acts as a formal request for payment, detailing the goods or services provided by the seller. The invoice typically includes a breakdown of the items or services, their quantities, unit prices, and the total amount due. Additional information such as any applicable sales tax, discounts, or special offers may also be included. By listing these details, an invoice outlines the buyer’s obligation to pay the specified amount and provides essential information regarding payment terms, such as the due date and acceptable payment methods.

For example, a freelancer who completes a project might issue an invoice to their client that lists the work performed, hourly rates, and the total cost. The invoice would also include the payment due date, the total sum owed, and instructions for how the client can submit payment, whether by bank transfer, credit card, or another method. This document serves as both a record for the seller of the products or services provided and as a reminder to the buyer that payment is required. The buyer is expected to settle the invoice within the stipulated timeframe, helping the business or freelancer maintain consistent cash flow.

From a business perspective, invoices are essential for tracking accounts receivable and managing finances. They help ensure that the business can track unpaid amounts and remind clients of their financial obligations. Invoices also play a crucial role in accounting practices, as they provide a detailed record of sales and transactions that can be used for financial reporting and tax purposes. Businesses often issue invoices when providing products or services on credit, meaning payment is due at a later date.

On the other hand, a receipt is issued by the seller only after the payment has been made. A receipt acknowledges that payment has been received and serves as proof of purchase. Unlike an invoice, which details the amount owed, a receipt confirms that the buyer has fulfilled their payment obligation. The receipt typically includes information such as the total amount paid, the date of payment, the payment method (e.g., cash, credit card, or check), and a description of the items or services purchased.

For instance, when a customer purchases a product from a store and pays at the register, they are given a receipt. The receipt confirms that the payment was processed, providing a record that the transaction is complete. The buyer can use the receipt for various purposes, including expense tracking, warranty claims, or returns. In many cases, a receipt also acts as a guarantee of the transaction, providing the buyer with the necessary documentation to claim refunds or exchanges if needed.

For businesses, receipts are important for maintaining accurate financial records. They provide evidence that payment has been received and allow businesses to reconcile their accounts. Additionally, receipts are often required for tax purposes, as they serve as proof of income for the business and may be used to report sales during tax filings.

The main difference between an invoice and a receipt lies in their timing and function. An invoice is a request for payment issued before the transaction is completed, while a receipt is confirmation of payment, issued after the transaction has been fulfilled. Both documents are crucial for maintaining transparency and accountability in financial transactions. They help businesses and customers stay organized, ensuring that payments are made, recorded, and tracked accurately. Whether you are issuing an invoice to request payment for services rendered or providing a receipt to confirm that a payment has been received, both play an indispensable role in the business world. Understanding their differences ensures that businesses can keep track of their revenue and manage their financial operations effectively while providing customers with the necessary documentation for their purchases.

What Is an Invoice?

An invoice is a request for payment sent to the buyer by the seller after goods or services have been provided. For example, if a customer purchases multiple items from a store, the seller generates an invoice listing the products, quantities, prices, and the total cost. The invoice serves as an official record, indicating the amount owed by the buyer before they make payment.

A well-structured invoice typically contains several key elements:

- Invoice Number: A unique reference number to track the invoice.

- Date: The date the invoice was issued.

- Seller Information: The seller’s name, address, and contact details.

- Buyer Information: The buyer’s name and contact information.

- Description of Products/Services: A detailed list of the products or services provided, including unit prices and quantities.

- Payment Terms: The deadline and payment instructions.

- Tax Information: If applicable, details on sales tax or VAT.

- Discounts: Any applicable discounts or promotions.

- Total Amount Due: The total cost, including taxes and discounts.

Invoices are vital for accounting and revenue tracking, and they serve as evidence of the transaction if any disputes arise. They are also useful for tax reporting and maintaining financial order.

What Is a Receipt?

A receipt is a document issued by the seller to the buyer once payment for the goods or services has been received. It acts as proof of purchase and provides a record of the completed transaction. Unlike an invoice, which is issued before payment, a receipt is generated only after payment has been made.

Receipts generally contain the following information:

- Receipt Number: A unique reference number for tracking.

- Date: The date payment was received.

- Seller Information: The seller’s name, address, and contact details.

- Buyer Information: The buyer’s name (if different from the recipient of the invoice).

- Description of Payment: A summary of what was paid for, including product details.

- Payment Method: The method of payment, such as cash, credit card, or check.

- Total Amount Paid: The amount paid by the buyer.

Receipts are crucial for financial record-keeping and are often required for returns, refunds, or warranty claims. They also help buyers track their spending and manage their personal or business finances.

Why Invoices and Receipts Are Essential

Invoices and receipts are vital tools for businesses, each serving distinct but interconnected functions within the broader financial framework. These documents help businesses maintain clarity in their financial dealings, ensuring transparency, accuracy, and professionalism in all transactions.

An invoice is essential because it formally requests payment for goods or services provided. It serves as a record of the transaction, listing the items sold, their quantities, prices, and any taxes or discounts applied. In addition to facilitating the payment process, invoices also help businesses track their revenue and manage accounts receivable. They provide a detailed breakdown of what the buyer owes and create a clear timeline for payment, which is crucial for maintaining healthy cash flow and ensuring financial stability. For businesses offering credit or delayed payments, invoices are especially important as they set the terms of payment and provide legal documentation should any payment disputes arise.

On the other hand, receipts are equally indispensable as they confirm that payment has been received. After payment is made, the receipt provides evidence that the transaction is complete, offering both the buyer and seller a document that certifies the exchange of goods or services for money. This document is particularly useful for record-keeping, enabling businesses to track payments and close the loop on sales. Receipts also serve as a vital tool for customers, who may need them for warranty claims, product returns, or tax deductions. For businesses, receipts are also crucial for reconciling accounts, ensuring that the amounts received match what was invoiced.

Ultimately, invoices and receipts are crucial for building trust between businesses and customers, providing clear financial records, and ensuring compliance with tax regulations. Together, they form the backbone of an efficient financial management system, helping businesses keep their operations organized and their transactions transparent.

Invoices:

An invoice plays a crucial role in the financial ecosystem of any business. It is not just a document that requests payment for goods or services rendered, but also a formal record that binds the buyer to pay the specified amount. By providing a detailed breakdown of the transaction, including item descriptions, quantities, prices, and applicable taxes, an invoice ensures that both parties have a clear understanding of what is owed and what is being provided. This clarity is fundamental for avoiding disputes and ensuring smooth financial operations.

Moreover, invoices are indispensable for businesses to effectively track their sales and revenue. They act as an official record of all transactions, providing a paper trail that helps businesses monitor cash flow. For companies that rely on credit terms, invoices also serve to remind customers of their financial obligations and help enforce payment timelines. Without a proper invoice system, businesses would struggle to track outstanding payments and may face cash flow challenges, which can affect overall operations.

Invoices are also essential for tax compliance. They document taxable transactions, ensuring that businesses can accurately report sales tax, VAT, or other applicable levies to tax authorities. This documentation helps businesses maintain transparency in their financial practices, reducing the risk of errors during audits or tax filings. By adhering to invoicing best practices, businesses can demonstrate their commitment to complying with tax laws, helping to avoid fines and penalties.

In addition to financial tracking and legal compliance, invoices also reflect the professionalism of a business. A well-crafted, clear, and organized invoice enhances the company’s image, showing customers that they are dealing with a reliable and trustworthy organization. A professional invoice not only encourages prompt payment but also fosters long-term relationships with clients, building trust and credibility over time. In this way, invoices play an integral role in maintaining financial order, ensuring timely payments, and enhancing business reputation.

Receipts:

Receipts are vital documents that confirm a payment has been successfully processed, providing both businesses and customers with tangible proof of a completed transaction. For businesses, receipts play a central role in maintaining accurate and organized financial records. By documenting the payment received, receipts help businesses reconcile their accounts, track revenue, and ensure that all payments are properly recorded in their financial system. This is particularly essential for businesses that handle numerous transactions daily, as receipts act as a clear, traceable record of every sale.

From an accounting perspective, receipts are indispensable for effective financial management. They serve as primary records for cash flow monitoring, enabling businesses to match received payments with the corresponding invoices. This assists in keeping the business’s financial status transparent and up to date, aiding in budget forecasting and planning. In addition, receipts support businesses during tax filing. They provide the necessary proof of income for tax authorities, ensuring that sales and revenue are accurately reported. The presence of properly filed receipts can simplify tax audits and help avoid any potential issues with tax compliance.

Receipts also facilitate various customer services, including returns, refunds, and warranty claims. For instance, when a customer returns a product or requests a refund, the receipt is required to verify the original purchase. Similarly, receipts are often necessary to claim warranty services, ensuring that the product is eligible for repairs or replacements under the terms of the warranty agreement. This makes receipts an essential tool for both businesses and customers in resolving potential disputes or issues.

For customers, receipts offer more than just proof of payment. They serve as a reference for future actions, such as managing personal expenses, tracking business expenditures, or making warranty claims. A well-organized system of receipts enables customers to keep track of their purchases, ensuring they have the necessary documentation when needed for returns, tax deductions, or financial planning. Overall, receipts are integral to ensuring smooth financial operations, fostering trust between businesses and customers, and supporting efficient financial management.

How to Create an Invoice

Creating an invoice is a crucial step in managing business transactions, as it ensures that both the seller and buyer have a clear understanding of the payment terms. While invoices can be created manually, using an invoice generator simplifies the process, making it more efficient and error-free. Manual invoicing requires gathering all relevant details, such as the buyer’s contact information, product or service descriptions, prices, and payment terms. You can create a template using software like Microsoft Word or Excel, but this approach can be time-consuming and prone to mistakes, especially for businesses with a large volume of transactions.

Using an invoice generator is a faster and more effective solution. The first step in creating an invoice with a generator is to gather all the necessary details. This includes the seller’s and buyer’s contact information, a clear description of the products or services provided, the prices, applicable taxes, and any discounts. Collecting these details beforehand ensures that the invoice is accurate and complete.

Next, design the invoice. A professional layout is essential for ensuring that the information is clear and easy to read. Invoice generators typically offer customizable templates that help you maintain a consistent, polished look for every transaction. A well-organized invoice reflects positively on your business and makes it easier for clients to process payments promptly.

After designing the invoice, assign a unique invoice number. This is crucial for tracking purposes, as it helps both you and your client refer to a specific transaction if any issues arise. Once the invoice details are in place, calculate the totals. Double-check that taxes, discounts, and final amounts are correctly applied. Errors in this step can lead to confusion and delayed payments, so it’s essential to ensure everything is accurate.

Once the invoice is complete, save it as a PDF and send it to the buyer. Emailing the invoice provides a quick and efficient method for clients to receive it, and the PDF format ensures that the invoice remains unchanged. Using an invoice generator makes it easy to streamline your invoicing process, helping you maintain professionalism, stay organized, and manage payments more effectively.

How to Create a Receipt

Creating a receipt is a straightforward process, yet it is essential for both businesses and customers to keep track of completed transactions. A receipt acts as an official confirmation that payment has been received for goods or services rendered. While you can create a receipt manually using a template or software such as Microsoft Word or Excel, using an online receipt generator simplifies the process, saving both time and effort. This tool can ensure accuracy and consistency, especially for businesses that handle multiple transactions daily.

To begin, the first step in creating a receipt is to collect all the necessary payment details. This includes the payment date, amount paid, method of payment, and specific transaction information. For example, if a customer paid by credit card, the receipt should note the payment method used. If the transaction was completed via cash, this must be indicated as well. Additionally, if the payment pertains to a specific product or service, it’s important to include those details clearly to provide context for the payment. Having all of these details in place before generating the receipt ensures that the document is complete and accurate.

The next step is to design the receipt itself. This can be done by choosing a clean and professional layout that clearly displays all the relevant information. A concise format is essential to avoid clutter and to make it easy for the recipient to find key details quickly. The receipt should include the name and contact information of the business, along with the buyer’s information if applicable. The description of the transaction, including what was purchased and the total amount paid, should also be prominently featured. This helps ensure that both the buyer and the seller are on the same page regarding the transaction.

Another important aspect of creating a receipt is including a unique receipt number. This number serves as a reference point for future inquiries or disputes. It allows both the business and the buyer to easily track the transaction in case of any follow-up questions or issues. The receipt number also adds a layer of organization and professionalism to the document, which can be helpful when dealing with large volumes of transactions. It’s particularly useful for businesses that need to maintain accurate financial records and reconcile payments efficiently.

Once the receipt is designed and all the information has been entered, the next step is to save the receipt as a PDF. The PDF format ensures that the document remains in its original form and cannot be altered. After saving the receipt, it can be sent to the buyer for their records. This is often done via email for convenience and speed, but the receipt can also be printed and mailed if preferred. The buyer should receive the receipt promptly, as it serves as proof of payment and may be required for returns, refunds, or warranty claims.

Using an online receipt generator streamlines this process even further by automatically populating many of the required fields, reducing the chance for human error. These tools also allow for customization, so businesses can tailor the receipt to reflect their brand and ensure consistency across all transactions. Whether you’re managing a small business or handling multiple transactions in a day, using an online receipt generator can greatly simplify the task of creating and sending receipts, making the entire process more efficient and professional.

Overall, the ability to create receipts quickly and accurately is crucial for maintaining smooth business operations. By following the steps outlined above and using efficient tools like receipt makers, businesses can ensure that they provide the necessary documentation to their customers while keeping their financial records in order.

Conclusion

Invoices and receipts are both vital documents that help businesses manage their financial operations smoothly. Despite serving different purposes, they complement each other and play integral roles in tracking transactions, maintaining financial accuracy, and ensuring transparency between businesses and customers. A clear understanding of these two documents and how they function within the payment cycle is essential for any business striving to maintain organized and effective financial management.

Invoices serve as the starting point of a transaction, acting as a formal request for payment. They outline the details of the products or services provided, the quantities, the agreed-upon prices, and any applicable taxes or discounts. An invoice typically includes the seller’s and buyer’s contact information, a breakdown of the costs, payment terms, and the total amount due. In essence, an invoice tells the buyer exactly what they owe and sets the expectations for when and how payment should be made. For businesses, invoices are more than just requests for payment; they act as official records that help keep track of sales and accounts receivable, ensuring that every transaction is properly documented.

From a business perspective, the invoice serves several critical functions. First and foremost, it ensures that the business can track payments owed by customers, helping to maintain a healthy cash flow. This is especially important for businesses that offer credit terms or deferred payment arrangements. Invoices also provide a clear paper trail for both accounting purposes and tax compliance, helping businesses prepare for audits and tax filings. A well-structured invoice, with all necessary details included, demonstrates professionalism and helps establish a trustworthy relationship with customers. It conveys that the business is organized, reliable, and committed to maintaining clear financial practices.

On the other hand, receipts are issued after payment has been made and act as proof that the transaction is complete. Unlike invoices, which are sent before payment, receipts confirm that the seller has received the agreed-upon payment. A receipt typically includes the date of payment, the total amount paid, the payment method, a brief description of the items or services purchased, and a unique receipt number for tracking purposes. In many ways, receipts are the final step in the transaction process, offering assurance to customers that their payment has been successfully processed and recorded.

For businesses, receipts serve as an official record of payments received, which is crucial for financial management and accounting. Receipts allow businesses to reconcile their accounts, track payments, and ensure that no discrepancies exist between the amounts billed and the amounts received. They are also essential for tax reporting, as they help document income for tax filings. Without receipts, it would be difficult for businesses to track the success of their sales or prove that they have fulfilled their financial obligations.

From the customer’s perspective, receipts are equally important. They provide customers with proof of purchase, which is often required for returns, refunds, or warranty claims. Additionally, receipts serve as essential documentation for personal finance management, helping customers keep track of their expenses and budget effectively. Receipts also help customers maintain organized records for tax purposes, expense reports, or even future transactions related to the same product or service. By providing clear, accurate receipts, businesses ensure that customers have the necessary documentation to manage their purchases with ease.

In today’s digital age, creating invoices and receipts has become easier and more efficient than ever before. Modern tools such as invoice generators and receipt makers streamline the process, allowing businesses to generate these documents quickly, accurately, and professionally. These tools offer numerous benefits, including customizable templates that allow businesses to tailor their invoices and receipts to reflect their brand’s identity. Furthermore, online platforms that generate invoices and receipts automate many of the steps, such as calculating taxes, discounts, and totals, reducing the chances of human error. The ability to quickly generate professional-looking invoices and receipts also saves time and enhances business efficiency.

For businesses that handle numerous transactions, the use of automated invoice generators and receipt makers is especially valuable. These tools reduce the burden of manual data entry, minimize the risk of errors, and help businesses maintain consistent, accurate records. Additionally, they often allow for easy tracking and organization of invoices and receipts, making it easier to monitor outstanding payments, track income, and ensure that financial documentation is readily accessible for tax filing or audits.

These modern tools also help businesses stay organized. They enable businesses to store invoices and receipts digitally, reducing the need for paper records and making it easier to retrieve documents when needed. Digital storage of financial documents ensures that businesses have secure, accessible records that can be easily updated or referenced.

Overall, invoices and receipts are critical for ensuring that businesses can track financial transactions, manage accounts, maintain tax compliance, and foster professionalism in their operations. Understanding the functions and importance of both documents can help businesses improve their financial processes, reduce errors, and maintain transparency with customers. By utilizing modern tools like invoice generators and receipt makers, businesses can simplify the creation of these documents, save time, and ensure that they have accurate, error-free financial records that are easy to manage and retrieve. Whether a business is a small startup or a large corporation, these tools are invaluable for maintaining financial clarity, enhancing efficiency, and building trust with clients.