In the contemporary business landscape, effective financial management is a cornerstone of success. As businesses of all sizes strive to maintain control over their operations and finances, utilizing advanced tools to streamline processes has become not just a convenience but a necessity. Invoice template and receipt maker software play a crucial role in this context, offering a means to automate the creation of invoices and receipts, thus saving time and reducing human error. These tools not only contribute to operational efficiency but also help businesses maintain professionalism and enhance their reputation with clients.

Invoicing is one of the most common yet essential tasks for businesses, particularly in maintaining accurate financial records. Whether for a freelance service, a retail operation, or a large enterprise, generating invoices with clear, accurate details is vital. It ensures that transactions are documented properly and that clients can easily understand their charges. Similarly, receipts serve as proof of payment, an essential document in any transaction, offering both the business and the client peace of mind. With the advent of digital solutions, the manual process of creating invoices and receipts has become outdated. Instead, businesses now turn to invoice template and receipt maker software to create custom, professional documents that reflect their brand while maintaining accuracy.

One of the main advantages of utilizing invoice and receipt maker software is automation. These platforms allow businesses to automate calculations, ensuring that the invoice or receipt is error-free, which is crucial when dealing with large volumes of transactions. Many of these tools integrate with accounting software, offering seamless synchronization of financial data and simplifying the process of maintaining a comprehensive financial record. This integration ensures that every transaction is captured in real-time, giving businesses an up-to-date view of their finances without the need for manual input.

Moreover, many software solutions offer a range of customizable templates. These templates allow businesses to tailor their invoices and receipts to align with their branding and the specific nature of their transactions. Whether it’s the design, format, or content, businesses can choose from a variety of pre-built templates or create their own. The flexibility to customize the documents ensures that each one matches the business’s unique style and conveys professionalism. This customization capability is particularly beneficial for companies that want to leave a lasting impression on their clients, showing that they pay attention to detail and are invested in their business’s appearance.

The ability to accept payments online is another significant advantage provided by many of these tools. Integrating payment gateways such as PayPal, Stripe, or Square into the software allows businesses to accept payments directly through the invoice or receipt, improving the convenience for customers. This integration also reduces friction in the payment process, encouraging faster transactions and providing the customer with multiple payment options. Furthermore, many software solutions allow businesses to set up automatic reminders for unpaid invoices, helping to reduce overdue payments and maintain healthy cash flow.

When it comes to small and medium-sized businesses, cost-efficiency is often a top priority. Many invoice and receipt maker software options are available at no cost or offer free tiers, making them ideal for startups or businesses operating on a budget. These free options still provide essential features like customizable templates, expense tracking, and the ability to send invoices and receipts, ensuring businesses can maintain their financial operations without significant overhead costs. For larger businesses with more complex needs, premium versions of these tools offer advanced functionalities, such as multi-currency support, detailed financial reporting, and deeper integrations with other business management systems.

As businesses continue to embrace digital transformation, the role of invoice template and receipt maker software will only grow in importance. These tools not only simplify financial management but also help businesses project an image of professionalism and reliability. Whether for a small freelancer or a large corporation, the right invoicing software can optimize workflows, ensure accuracy, and improve client relations. When choosing a solution, it’s important to consider the business’s unique needs—whether it’s customization, mobile access, or payment integration—and find a software solution that meets those demands effectively. With the right tool in place, businesses can manage their invoicing and receipts with ease, allowing them to focus on what matters most: growth and customer satisfaction.

QuickBooks

QuickBooks stands as a prominent leader in the realm of accounting and finance software, offering a broad spectrum of tools that cater to businesses in need of efficient invoicing and receipt-making solutions. Designed with both small and large businesses in mind, QuickBooks provides an all-encompassing financial management system that goes beyond simple invoice generation. It seamlessly integrates with a company’s financial data, ensuring that all transactions are accurately tracked and recorded. This integration facilitates automatic calculations, eliminating the risk of human error and saving valuable time for business owners.

One of QuickBooks’ standout features is its customizable templates for invoices and receipts, allowing businesses to tailor documents to align with their brand identity. Whether it’s adjusting the layout, adding logos, or altering the color scheme, these customizable options ensure that invoices and receipts not only look professional but are uniquely aligned with the business’s visual identity. The software’s ability to automate calculations also ensures that clients receive accurate and timely invoices, significantly improving payment accuracy and reducing disputes. Furthermore, businesses can easily track payments, set reminders for overdue invoices, and even accept payments directly through the platform, making it a comprehensive solution for managing financial transactions.

For businesses that need more than just basic invoicing, QuickBooks shines with its robust accounting capabilities. It provides detailed financial reports, tax calculations, payroll management, and inventory tracking—all integrated within a single system. This makes it a powerful tool for businesses looking to streamline their entire financial operation. However, its versatility comes at a price. The advanced features and comprehensive functionality may come with a higher price tag, and the platform’s learning curve can be a challenge for beginners. While QuickBooks is highly regarded for its effectiveness and accuracy, these factors might limit its appeal to businesses with more basic needs or those just starting out. Despite this, QuickBooks remains a top choice for businesses seeking a reliable, scalable financial solution.

FreshBooks

FreshBooks is a cloud-based accounting software that stands out for its simplicity and ease of use, making it an excellent choice for small businesses and freelancers. The platform specializes in streamlining invoicing processes, offering an intuitive system that allows users to generate professional invoices with just a few clicks. With its customizable templates, users can personalize their invoices to match their brand identity, adjusting layouts, adding logos, and choosing colors. This flexibility ensures that businesses present themselves in a polished and professional manner, helping to foster trust with clients and customers.

One of the key benefits of FreshBooks is its seamless integration with online payment systems. Users can accept payments directly through their invoices, offering clients a convenient way to settle accounts. This feature is particularly valuable for freelancers and small business owners who need to receive payments quickly and efficiently. Additionally, FreshBooks simplifies expense tracking by allowing users to categorize and manage costs, creating a more accurate picture of a business’s financial health. This ease of use is one of the reasons FreshBooks is so popular among small enterprises, as it reduces the complexity often associated with more traditional accounting software.

However, while FreshBooks excels in these areas, it does have some limitations that businesses with more complex accounting needs should consider. Its accounting features, though effective for basic invoicing and financial management, are not as comprehensive as those offered by other solutions like QuickBooks or Xero. For larger businesses or those requiring advanced reporting, tax management, or payroll capabilities, FreshBooks may fall short. It lacks some of the in-depth financial analysis tools and integrations that other, more robust platforms provide. Despite these limitations, FreshBooks remains an excellent choice for small businesses and freelancers looking for a straightforward, cloud-based invoicing and receipt maker solution that simplifies their financial tasks without overwhelming them.

Zoho Invoice

Zoho Invoice is a versatile and cost-effective invoicing solution that is an integral part of the larger Zoho suite of business tools. Designed with freelancers and small businesses in mind, Zoho Invoice offers a wide range of features to streamline the invoicing process. One of its key strengths is the variety of customizable templates it provides, which allows users to create professional invoices tailored to their business needs. Whether it’s a simple invoice or a more detailed estimate, Zoho Invoice enables users to choose from multiple pre-designed templates or customize them to reflect their brand’s identity.

Beyond invoicing, Zoho Invoice offers additional tools that enhance its functionality, including time tracking and expense management features. These allow businesses to log their work hours, monitor billable activities, and track expenses, ensuring they maintain a comprehensive view of their financial operations. This integrated approach to financial management makes it an excellent choice for small business owners and freelancers who need to keep track of their time and expenses while maintaining accurate invoicing.

One of the most appealing aspects of Zoho Invoice is its budget-friendly pricing, which provides small businesses with a powerful invoicing solution without breaking the bank. Its affordability, combined with a seamless integration with other Zoho applications, such as Zoho CRM and Zoho Books, creates a cohesive environment for managing customer relationships and overall business operations.

However, while Zoho Invoice excels in its core invoicing, time tracking, and expense management functionalities, it does have limitations for businesses with more advanced accounting needs. For instance, it may lack the sophisticated reporting capabilities and in-depth financial analysis tools that larger businesses or more complex operations require. Businesses needing advanced features such as payroll management, tax automation, or intricate financial reporting may find Zoho Invoice somewhat limited. Despite these limitations, Zoho Invoice remains a solid and affordable choice for freelancers and small businesses seeking a straightforward, efficient invoicing and financial management solution.

Wave

Wave is a highly regarded free invoice generator and accounting software tailored for small businesses and startups. One of its most significant advantages is its completely free pricing model, making it an attractive solution for budget-conscious entrepreneurs who need essential accounting tools without the burden of expensive software. Wave’s free features include the ability to create customizable invoices, track expenses, and accept online payments. These features provide a solid foundation for managing financial operations, helping small business owners stay organized and ensure timely payments from clients.

Wave allows users to design invoices that align with their business branding, providing a variety of customizable templates that can be adjusted to suit specific needs. This flexibility is particularly beneficial for entrepreneurs who want to maintain a professional appearance without spending excessive time or money on design work. Additionally, Wave’s expense tracking functionality is a crucial feature for small businesses, enabling users to record and categorize expenses, ensuring that they can accurately manage their finances and monitor their cash flow.

The ability to accept online payments through Wave is another standout feature, streamlining the invoicing process and making it easier for clients to pay their bills. With integrated payment gateways, such as PayPal and Stripe, businesses can reduce friction in the payment process, making it more convenient for clients and improving cash flow for the business. This seamless payment integration helps businesses maintain a steady revenue stream without having to rely on traditional payment methods, which can often be slower.

Despite its many advantages, Wave does have its limitations, particularly when it comes to customer support for free users. The absence of robust support options can be frustrating for those who require more personalized assistance, especially if issues arise with the platform. Additionally, while Wave is perfect for small businesses and startups, it may not be suitable for larger businesses with more complex needs. For example, it lacks advanced accounting features, detailed financial reporting, and integrations with other enterprise-level software. Despite these drawbacks, Wave remains a strong contender for businesses looking for a free, easy-to-use solution for their invoicing and basic accounting needs.

Xero

Xero is a robust and comprehensive accounting software solution that is widely recognized for its broad set of features, including advanced invoicing tools. Designed to serve businesses of all sizes, Xero offers a seamless integration of accounting capabilities alongside its invoicing features, making it an ideal choice for organizations looking for a complete financial management system. One of the standout aspects of Xero is its diverse selection of customizable templates for invoices, which allows businesses to create professional and branded invoices tailored to their specific needs. Whether it’s a simple invoice or a more detailed document, Xero offers flexible solutions to suit a wide variety of business types.

In addition to its invoicing capabilities, Xero provides a comprehensive suite of accounting features, including bank reconciliation, financial reporting, tax management, and inventory tracking. These advanced tools ensure that businesses can manage their entire financial ecosystem from one platform, allowing for greater efficiency and accuracy. The software also integrates smoothly with a range of third-party applications, ensuring that businesses can streamline their financial operations by connecting with other essential tools such as payroll systems, payment processors, and customer relationship management (CRM) platforms.

Xero’s extensive features make it particularly suitable for medium to large businesses that require a comprehensive accounting solution. It provides the depth and flexibility needed to manage complex financial operations and offers detailed financial reports, making it easier for business owners to track their cash flow, profits, and expenses. However, its robust functionality comes with a downside—Xero can be overwhelming for beginners or small businesses that only require basic invoicing capabilities. The software’s complexity and relatively higher pricing may not make it the most suitable choice for entrepreneurs or businesses looking for a more straightforward, low-cost solution. Despite these challenges, Xero remains a top choice for businesses in need of an all-in-one accounting system with powerful invoicing features.

Zintego

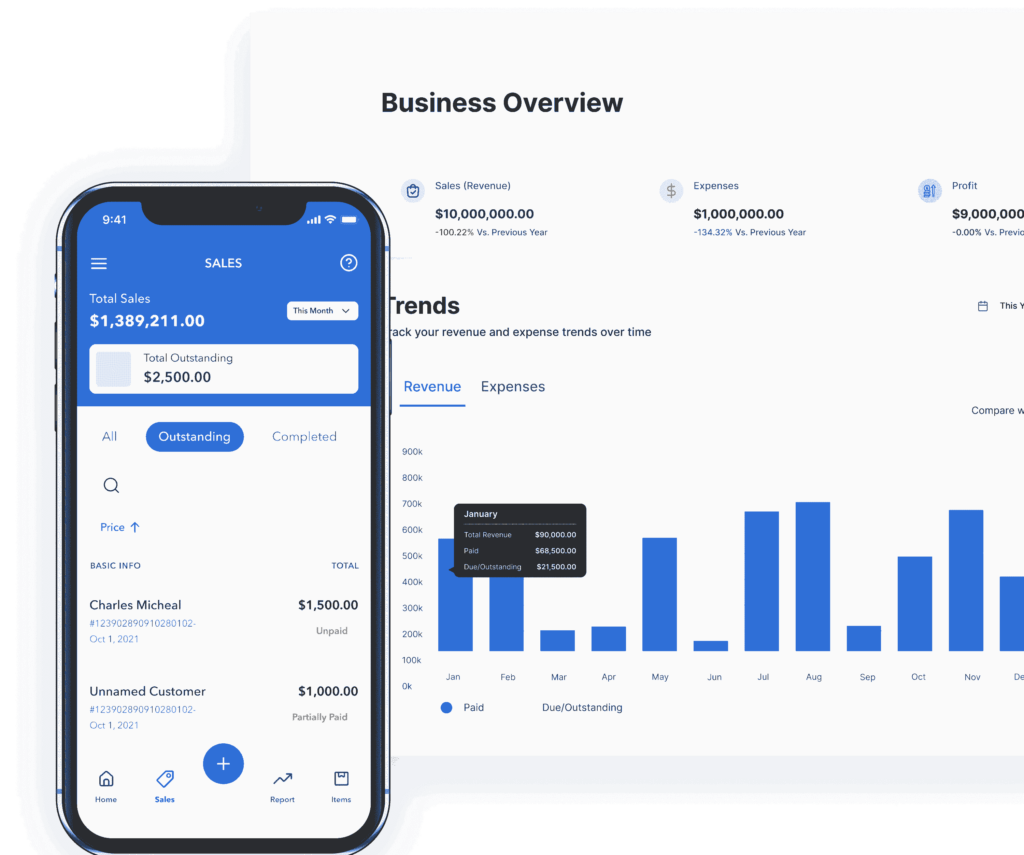

This mobile-focused invoicing and receipt maker software is designed specifically for businesses on the move. Its primary strength lies in its accessibility and convenience, making it an excellent solution for entrepreneurs and small business owners who need to manage their invoicing processes while out in the field. The software offers a range of customizable templates that allow users to create professional, branded invoices and receipts directly from their mobile devices. This feature ensures that businesses can present themselves with a polished image, even while working remotely or on client sites.

In addition to its customizable templates, the software includes expense tracking functionality, which is essential for business owners who need to monitor their spending on the go. By keeping track of expenses in real time, businesses can stay on top of their cash flow and ensure they are making informed financial decisions. The mobile payment acceptance feature further enhances the software’s practicality, enabling businesses to receive payments directly through their mobile devices. This feature is especially valuable for service providers, freelancers, and small businesses that require immediate payment processing in situations where they may not have access to traditional point-of-sale systems.

While the software excels in providing a user-friendly mobile experience, it does have its limitations. The accounting features are relatively basic compared to more comprehensive accounting software, which may not meet the needs of businesses that require detailed financial reporting, payroll management, or complex invoicing features. Additionally, the platform offers fewer integrations with other business tools, which could limit its effectiveness for businesses looking to integrate their invoicing system with a broader set of financial management tools. Despite these drawbacks, the software remains an excellent choice for mobile entrepreneurs seeking a straightforward and efficient solution for creating invoices and receipts on the go.

Square Invoices

Square Invoices is a purpose-built invoicing and receipt template platform developed by Square, a well-established name in the realm of payment processing. It is particularly advantageous for businesses that already rely on Square’s ecosystem, as it integrates flawlessly with Square’s payment infrastructure. This seamless integration allows businesses to manage invoicing and receive payments without the need for third-party tools or cumbersome manual processes. Entrepreneurs, retailers, and service providers find Square Invoices especially appealing due to its clean, intuitive interface that simplifies the creation and dispatch of invoices in just a few clicks.

The platform supports a variety of invoice customization options, allowing users to tailor their documents to match their brand identity. With the ability to adjust logos, layouts, and payment terms, businesses can maintain a consistent visual presentation while facilitating timely client payments. Additionally, Square Invoices includes features like automatic reminders for unpaid invoices, recurring billing, and real-time payment tracking. These tools collectively streamline the billing process and help maintain healthy cash flow by encouraging prompt payments and reducing the chances of overdue accounts.

Moreover, the mobile accessibility of Square Invoices makes it a highly flexible solution for small businesses and entrepreneurs who often operate outside traditional office environments. Invoices can be created and sent directly from a mobile device, which is ideal for contractors, freelancers, and field service professionals.

However, while Square Invoices is highly effective for basic invoice generation and payment collection, it may not fulfill the needs of businesses that require extensive accounting functionalities. It lacks more sophisticated features such as detailed financial reporting, inventory management, or payroll services, which are typically found in comprehensive accounting software. Despite these limitations, Square Invoices remains a dependable, user-centric solution for businesses seeking a streamlined invoice generator and receipt maker that integrates effortlessly with modern payment systems.

PayPal Invoicing

PayPal Invoicing provides a straightforward and highly efficient invoicing solution tailored for businesses and freelancers who rely on PayPal for transactions. This tool simplifies the process of creating and sending invoices directly through the PayPal platform, allowing businesses to easily issue invoices to their clients via email or by sharing a direct link. The software offers a range of customizable templates, enabling users to tailor their invoices to meet their specific business needs. Whether you’re a freelancer offering services or a small business providing products, PayPal Invoicing gives you the flexibility to design professional invoices that reflect your brand’s identity, ensuring consistency and professionalism in client communications.

One of the key benefits of PayPal Invoicing is its seamless integration with the PayPal ecosystem. Businesses already using PayPal for payment processing will find this tool particularly convenient, as it allows for smooth, real-time payment acceptance directly through the invoice. Clients can settle their bills instantly, which helps businesses maintain a steady cash flow. The platform also offers an intuitive interface that simplifies the entire process, ensuring that even users with minimal technical experience can create and send invoices without difficulty. Additionally, PayPal Invoicing includes basic features such as automatic payment reminders, helping businesses stay on top of overdue payments and reducing the likelihood of missed or delayed invoices.

Despite these strengths, PayPal Invoicing has limitations, especially for businesses with more complex accounting needs. While it offers robust invoicing and payment acceptance capabilities, it lacks the advanced accounting features found in more comprehensive solutions, such as detailed financial reports, tax calculations, or payroll management. Furthermore, PayPal Invoicing is most effective for businesses that primarily use PayPal as their payment method. It may not be the ideal choice for companies that require integration with multiple payment gateways or those that need more diverse payment processing options. Nevertheless, PayPal Invoicing remains a solid and accessible solution for small businesses and freelancers who rely heavily on PayPal for transactions and need a straightforward invoicing tool.

Invoicely

Invoicely is a versatile cloud-based invoicing platform specifically designed to meet the needs of freelancers, independent contractors, and small businesses. This dynamic invoice generator offers a user-friendly environment where users can create and send professional invoices with minimal effort. Invoicely’s customizable templates allow businesses to craft invoices and receipts that reflect their unique brand identity, incorporating elements such as logos, color palettes, and specific payment terms. These personalization features not only enhance the visual professionalism of the documents but also help reinforce a business’s brand presence with each transaction.

One of Invoicely’s standout features is its robust support for multi-currency and multi-language invoicing. This makes it particularly valuable for businesses that operate internationally or serve a diverse clientele across various geographic regions. The platform automatically adjusts currency formats and language preferences, enabling seamless communication and transaction clarity regardless of the client’s location. This capability sets Invoicely apart from many other tools in the market, positioning it as a go-to solution for globally minded entrepreneurs.

In addition to invoice creation, Invoicely includes built-in tools for expense tracking, allowing users to log and categorize expenses effortlessly. This functionality provides valuable insight into operational costs and helps maintain balanced books, making day-to-day financial management more precise. Users can also manage client databases, track hours worked, and generate detailed summaries that assist in keeping business operations transparent and organized.

Despite its strengths, Invoicely may not be ideal for businesses in need of comprehensive accounting functionality. It lacks deeper financial tools such as detailed tax reports, payroll services, or complex financial forecasting features. Additionally, while the platform is effective on its own, its integration capabilities with other enterprise software are limited compared to more expansive accounting ecosystems. Still, for freelancers and small businesses looking for an accessible, international-friendly receipt maker and invoicing solution, Invoicely delivers impressive value with a sleek and functional interface.

Hiveage

Hiveage is a cloud-based invoicing and billing platform crafted to meet the diverse needs of small to mid-sized businesses. Designed with flexibility and usability in mind, Hiveage enables users to create and send invoices quickly using a variety of customizable templates. These templates can be tailored to reflect the brand’s identity, from colors and logos to layout preferences, ensuring that each invoice or receipt not only conveys billing details but also reinforces brand professionalism. The platform serves as a streamlined invoice generator and receipt maker, perfect for businesses looking to elevate their client-facing documents.

Beyond its invoice template functionality, Hiveage delivers a suite of features that extend well beyond basic billing. One of its standout capabilities is time tracking, which allows service-based businesses to log hours directly into the platform and convert them into invoices with ease. This is especially beneficial for consultants, freelancers, and agencies that bill based on hourly projects. Expense management is another integral feature, enabling businesses to document and categorize expenditures, which supports improved financial oversight and control.

Hiveage supports multiple payment gateways, allowing businesses to accept payments through various providers such as PayPal, Stripe, and Authorize.Net. This flexibility empowers clients to choose their preferred method, which can help speed up payment turnaround times and improve cash flow consistency. Additionally, the software is accessible from any device with an internet connection, enhancing mobility for entrepreneurs who need to manage finances while on the go.

Despite its many advantages, Hiveage is not a full-fledged accounting solution. It lacks complex accounting functionalities such as tax filing, detailed financial forecasting, and in-depth analytic reporting. These omissions may pose a challenge for businesses with more intricate financial structures or compliance needs. However, for businesses seeking a reliable, easy-to-use billing tool with strong invoice and receipt capabilities, Hiveage presents a polished and practical solution that supports streamlined financial operations.

Billdu

Billdu is an efficient invoicing and receipt maker software that caters to small and medium-sized businesses, providing a versatile set of tools for managing financial tasks. With a range of customizable templates, Billdu allows businesses to create professional invoices, receipts, and estimates that align with their brand’s unique identity. Whether you’re a freelancer or a small business owner, the software offers flexibility to modify layouts, colors, and logos, ensuring that all client-facing documents reflect your business’s professionalism and style.

One of the standout features of Billdu is its mobile invoicing capability. The mobile app allows users to create and send invoices directly from their smartphones or tablets, which is especially beneficial for entrepreneurs and service providers who are often on the move. This mobile accessibility ensures that business owners can handle billing and financial tasks wherever they are, improving efficiency and ensuring no invoice is delayed due to location constraints. The mobile app also syncs seamlessly with the desktop version, ensuring that all financial records are up-to-date and accessible at all times.

In addition to its invoicing capabilities, Billdu includes expense tracking, helping users maintain a clear overview of their spending. The software allows businesses to categorize and monitor expenses, ensuring that budgeting remains transparent and that business owners can track their financial health. Billdu also offers the ability to create quotes and estimates, adding another layer of functionality for businesses that require these tools for client negotiations.

While Billdu offers strong core features, it is not without its challenges. For beginners, the platform’s learning curve can be steep, requiring some time to get accustomed to its more advanced functionalities. Furthermore, the reporting options, while useful, could be more extensive for businesses that require detailed financial insights or complex analysis. Despite these drawbacks, Billdu remains a powerful and mobile-friendly invoicing tool that provides an all-in-one solution for small to medium-sized businesses looking to streamline their financial operations.

Sage Business Cloud Accounting

Sage Business Cloud Accounting is a comprehensive accounting software with integrated invoicing features. It offers customizable templates and seamlessly integrates with other Sage products, making it suitable for businesses with complex accounting needs.

Sage offers full accounting capabilities along with customizable invoice templates. However, its complexity and higher pricing could make it overwhelming for businesses that only need basic invoicing functionality.

Comparing the Top 12 Invoice Template and Receipt Maker Software Companies

When comparing these 12 software solutions, several key criteria help businesses make a choice.

Ease of Use

For those who prioritize a simple and user-friendly interface, FreshBooks, Wave, Invoice2go, and Square Invoices stand out. They offer intuitive platforms that make them ideal for individuals or small businesses with limited accounting expertise.

Customization

If you are looking for flexibility in your invoice and receipt templates, QuickBooks, Zoho Invoice, Xero, Invoicely, and Hiveage offer a wide range of customizable templates that allow you to tailor documents to your brand’s needs.

Payment Processing

Businesses that need integrated payment options should consider Square Invoices, PayPal Invoicing, and Invoice2go. These solutions offer integrated payment processing, streamlining the invoicing and payment collection process.

Mobile Access

For entrepreneurs and businesses on the go, Invoice2go, Billdu, and PayPal Invoicing provide mobile apps that allow you to manage invoices from your smartphone or tablet, ensuring connectivity even when away from the office.

Expense Tracking

Xero, Zoho Invoice, Hiveage, and Billdu offer effective expense tracking capabilities, which is crucial for businesses that need to monitor their financial outgoings.

International Support

Invoicely and Hiveage support multiple currencies and languages, making them excellent choices for businesses with international clients or customers.

Accounting Integration

For those who need a comprehensive accounting solution along with invoicing features, QuickBooks, Xero, and Sage Business Cloud Accounting offer full accounting capabilities, providing a more holistic financial management tool.

Pricing

Pricing varies greatly among these tools. Wave is a free solution ideal for startups and small businesses on a tight budget. However, while free options like Wave are appealing, they may lack advanced features, customer support, and scalability for growing businesses. It’s essential to evaluate your business needs and budget before selecting a solution.

Conclusion

Selecting the most suitable invoice template and receipt maker software is a foundational step in optimizing the financial workflows of any modern business. In a world where efficiency, speed, and precision define success, relying on manual systems or outdated methods for generating invoices and receipts can lead to delays, errors, and lost revenue. Implementing the right digital solution not only enhances operational efficiency but also helps solidify trust and transparency with clients. Whether you are a solopreneur, a startup, or an expanding enterprise, having the right invoicing tools can significantly influence your ability to manage transactions, track expenses, and maintain consistent cash flow.

The market offers a diverse range of solutions, each tailored to specific business sizes and operational complexities. For example, Fresh Books appeals to freelancers and small teams with its intuitive interface and quick setup process. It provides all the essentials—from customizable invoice templates to online payment acceptance—in a streamlined, cloud-based environment. In contrast, a platform like Xero caters to businesses with more advanced needs, offering full-fledged accounting functionality alongside invoicing, tax management, and integration with financial reporting tools. These variations underscore the importance of choosing software that aligns precisely with your business requirements rather than adopting a one-size-fits-all approach.

A standout feature among the best tools is the ability to personalize invoices and receipts using flexible templates. Businesses benefit greatly from the capability to incorporate their branding into these documents, projecting a consistent and professional image across all client interactions. Furthermore, the inclusion of features like expense tracking, automated reminders, and online payment gateways ensures that financial operations remain fluid and customer-friendly. These functionalities reduce the administrative burden on business owners and help expedite payment collection, improving liquidity.

Mobile accessibility has become another essential aspect of receipt and invoice management. Entrepreneurs who are often on the move or work in the field appreciate platforms that offer mobile apps or responsive interfaces that allow for on-the-go invoicing. This level of agility ensures that transactions can be managed in real time, preventing delays and maintaining accurate financial records regardless of location.

While evaluating software, businesses must also consider integration capabilities. Tools that seamlessly sync with accounting platforms, customer databases, and inventory systems contribute to a more cohesive business ecosystem. Such integrations reduce data silos, enhance reporting accuracy, and allow for a more comprehensive view of financial health.

Cost is another key factor. Free options like Wave provide excellent value for startups, offering essential tools without the financial commitment. However, as businesses grow and their needs become more complex, they may benefit from investing in premium platforms that offer enhanced features, deeper analytics, and greater customization.

Ultimately, the best invoice generator or receipt maker is the one that not only fulfills your immediate needs but also scales with your business. By carefully analyzing functionality, ease of use, scalability, mobile access, and integration capabilities, you can make an informed decision that will support your business well into the future. Choosing the right software is not just about managing invoices—it’s about investing in a tool that elevates your overall financial strategy and ensures you remain organized, professional, and prepared for growth.