Co-working spaces have revolutionized the way freelancers, remote workers, and startups approach their work environment. By offering a blend of flexibility, productivity, and unparalleled networking […]

Author: Albert Flores

Mastering Time Management: Techniques for Entrepreneurs

In today’s fast-paced business world, effective time management stands out as a critical skill for entrepreneurs. It is not merely about managing one’s schedule but […]

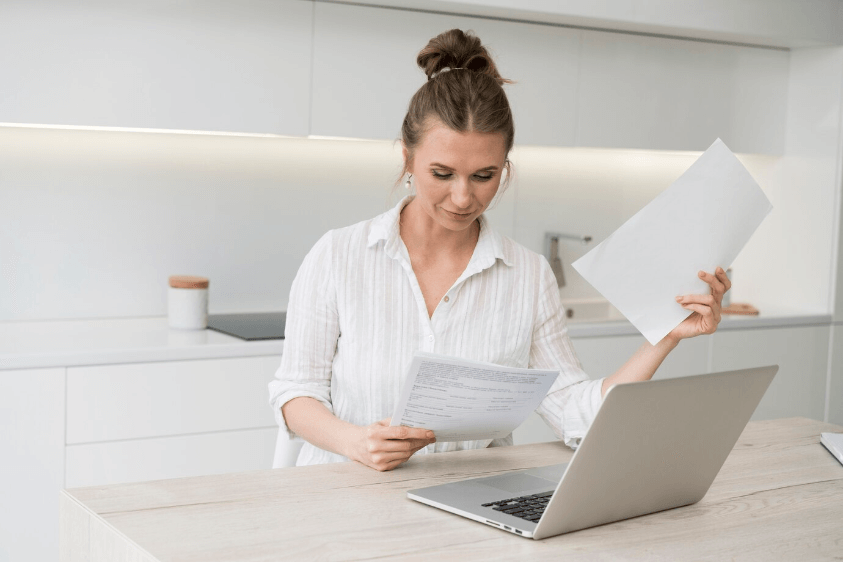

Navigating Business Insurance: What Small Businesses Need to Know

Navigating the complex landscape of business insurance can seem daunting for small business owners. With a myriad of policies available, understanding the nuances of each […]

Understanding Prorated Billing: Definitions and Mechanisms

Prorated billing is an essential concept in finance and billing practices, touching various sectors, including telecommunications, utilities, subscriptions, and rentals. This mechanism allows businesses to […]

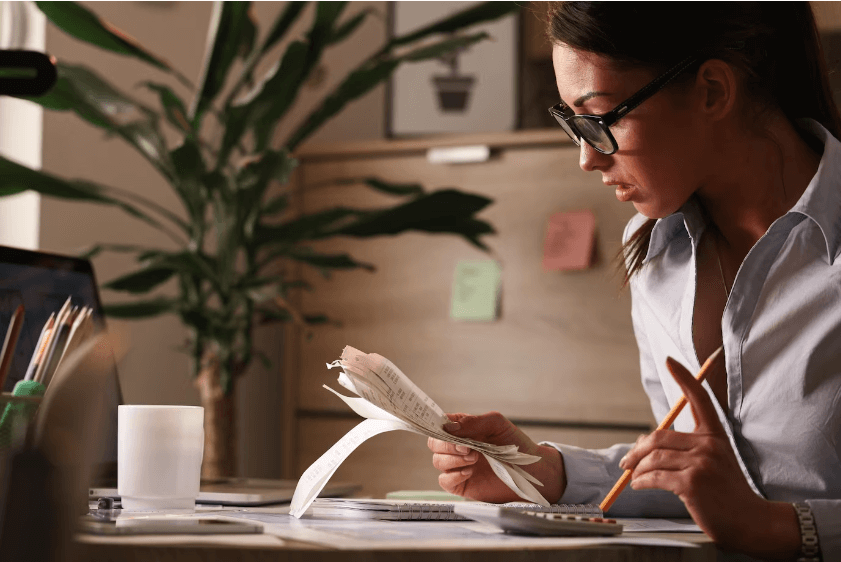

Top 10 Essential Key Performance Indicators for Monitoring Accounts Receivables

In the fast-paced world of finance and accounting, maintaining a healthy cash flow is paramount for the survival and growth of any business. Monitoring Key […]

An In-Depth Guide to Usage-Based Billing

In the rapidly evolving digital economy, the traditional one-size-fits-all pricing model has given way to more flexible and consumer-friendly strategies. Usage-based billing stands at the […]

Merchant Accounts Vs. Payment Service Providers

In the digital age, businesses face the critical choice between traditional merchant accounts and modern payment service providers for processing customer transactions. This decision touches […]

The Role of Merchant Accounts in E-commerce Growth

In the evolving landscape of e-commerce, the mechanisms behind payment processing stand as foundational pillars for business success. Understanding the distinctions between traditional merchant accounts […]

Unified Invoicing Explained: What It Is and How to Generate One

Unified invoicing represents a streamlined approach to billing, aiming to simplify the invoicing process for both businesses and customers. This innovative system consolidates multiple charges […]

Enhancing Protection in Credit Card Transactions: Essential Strategies for Enterprises

In an era where digital transactions are the norm, the security of credit card transactions has become paramount for businesses across all sectors. This article […]