Free Word Invoice Templates

Our Downloadable Word Invoice Templates Offer a User-friendly and Professional Solution for Creating Invoices with Ease.

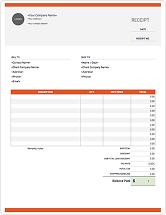

Downloadable Free Word Invoice Templates

Choose from a diverse range of templates that match your business style and preferences. Once you've selected the template that suits your needs, simply download it, customize it with your client's information, details of the goods or services provided and pricing. These templates are designed to help you quickly generate polished and well-structured invoices that leave good impression on your clients. With our downloadable Word invoice templates, you can streamline your invoicing process, ensuring professionalism and efficiency in your business communications.

Highlights of Word Invoice Templates

Blank Word invoice templates that are ready to send to clients.

Fully customizable templates to fit the needs of your unique business.

Professionally formatted with all the essential invoice elements included.

Frequently Asked Questions

What Our Customers Say About Using Zintego

Build a Custom Invoice

Create the perfect Word invoice for your business with our Online Invoice Generator.

TRY IT