Generating an invoice is an essential part of business operations, ensuring that you get paid for the products or services you’ve provided. There are several tools available to help simplify this process, and two of the most commonly used options are Excel invoice templates and online invoice generators. Both of these methods offer unique benefits, but understanding the strengths and limitations of each will help you determine which is best suited to your needs.

Excel invoice templates have long been a staple for businesses, offering a versatile and customizable solution. An Excel invoice template is essentially a pre-designed document where all the necessary fields for an invoice are laid out for you. This allows you to easily input the details of the products or services you’ve sold, as well as your company’s information, client details, payment terms, and amounts due. Once you’ve filled in the required fields, you can save the document in various formats, such as PDF or Excel, and send it to your client via email or print it out for physical delivery.

One of the significant advantages of using an Excel invoice template is the level of customization it offers. You can modify the layout, colors, and fonts to match your brand, ensuring that your invoices reflect your company’s identity. Additionally, Excel allows you to easily calculate totals and taxes using built-in formulas, which helps prevent errors and ensures accuracy in the final invoice. For businesses that are already familiar with Excel, this method is quick and easy, allowing you to generate multiple invoices with minimal effort.

However, Excel invoice templates are not without their drawbacks. The process of creating invoices can become time-consuming if you have a large volume of clients or frequent billing cycles. While Excel offers customization, it doesn’t provide advanced features such as automatic reminders for overdue payments or the ability to store client information for future invoices. For businesses with high invoicing volumes, this could result in inefficiencies. Additionally, managing invoices across multiple spreadsheets can lead to disorganization and difficulty tracking payments.

On the other hand, online invoice generators offer a simpler, faster solution for creating invoices. These web-based tools allow you to generate invoices directly from your browser without the need for any additional software. To create an invoice using an online generator, you simply input the relevant details, such as your business name, client information, items sold, payment terms, and amounts due. The generator then automatically formats the invoice and allows you to download it as a PDF. This method is ideal for businesses that require quick invoicing on the go, especially for freelancers or small businesses.

The primary benefit of an online invoice generator is its simplicity and accessibility. Since the tool is available online, you can create and send invoices from virtually anywhere, whether you’re working from your desktop, laptop, or even a mobile device. It’s particularly useful for those who don’t have extensive experience with spreadsheet software or for businesses that only need to generate occasional invoices. Another advantage is that many online invoice generators are free to use, making them a cost-effective solution for smaller businesses and freelancers.

However, online invoice generators come with limitations as well. They typically offer limited customization options, and you may not be able to tailor the invoice’s design to fit your brand. Additionally, most online tools don’t allow you to track invoice status, save customer details for recurring invoices, or manage overdue payments. For businesses that need to track payments or store client information for future reference, an online generator might not provide the level of functionality required. Furthermore, if you use an online invoice generator, you must rely on the internet, which could be a hindrance in areas with unreliable connectivity.

For businesses seeking a more robust solution, invoicing software is another option worth considering. This type of software combines the best features of both Excel templates and online generators, offering easy-to-use tools for creating invoices along with advanced features such as payment tracking, reminders, and the ability to store customer and product information. Some software solutions even integrate with accounting software, streamlining the entire invoicing and financial management process. The main downside is that invoicing software can come with a subscription fee, though many offer free versions with limited features.

Ultimately, the best solution for your business depends on your needs. If you require a high level of customization and have experience with Excel, using an invoice template may be the most efficient option. For businesses on the go or those seeking a simple solution, an online invoice generator can offer quick, hassle-free invoicing. And for those who need advanced features like tracking and automation, invoicing software can save time and improve accuracy. Regardless of which method you choose, having a reliable invoicing system is essential for ensuring that you receive timely payments and maintain professional relationships with your clients.

What is Excel Invoice Maker?

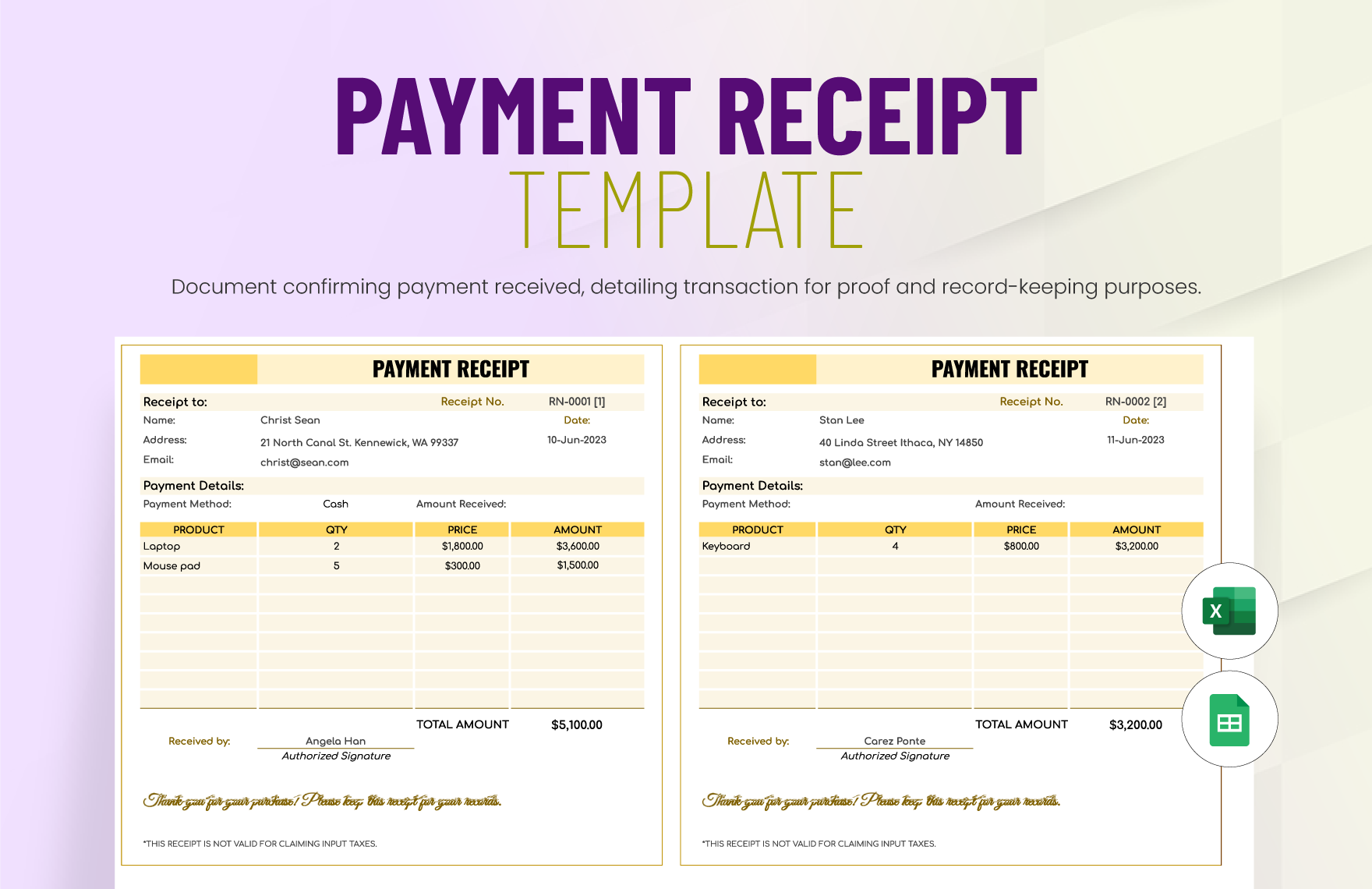

An Excel receipt maker is a tool that simplifies the process of creating professional receipts using Microsoft Excel. Receipts are crucial for both businesses and individuals as they provide a formal record of a transaction between two parties. Whether you’re selling a product, offering a service, or simply providing a proof of payment, a receipt serves as documentation that can be used for accounting, tax purposes, or simply for record-keeping. Excel receipt makers are particularly useful because they allow users to easily create and manage receipts in a digital format that can be saved, printed, or emailed directly to customers.

The beauty of an Excel receipt maker lies in its versatility and customizability. Unlike traditional paper receipts, which are often hard to manage and store, digital receipts created in Excel can be easily edited, updated, and saved for future reference. These templates typically contain predefined fields for essential transaction details, such as the business name, address, and contact information, as well as fields for customer details, items purchased, quantity, price, tax, and total amount paid. Most Excel receipt makers also have built-in formulas to automatically calculate totals, taxes, and discounts, which helps to prevent errors and save time.

One of the advantages of using an Excel receipt maker is the ease with which you can customize the format to suit your brand’s style. You can change the colors, fonts, and layout to match your business’s identity, ensuring that your receipts reflect your professional image. Additionally, Excel allows you to add logos and other branding elements, further enhancing the appearance and credibility of your receipts. This level of customization helps create a more personalized and polished document, which can improve customer trust and satisfaction.

For businesses that handle a high volume of transactions, an Excel receipt maker can be particularly valuable. Since Excel receipts are digital, they can be easily stored in a secure folder on your computer or cloud storage, making it much easier to retrieve and track past transactions. This is particularly important for businesses that need to maintain a record of their sales for tax filing or accounting purposes. Unlike paper receipts that can get lost or damaged, digital receipts in Excel are permanent and can be backed up to ensure that you never lose crucial financial information.

Another benefit of using an Excel receipt maker is its accessibility. Whether you are working from a desktop, laptop, or tablet, you can create receipts anytime and anywhere. This makes it especially convenient for small business owners, freelancers, or anyone who needs to generate receipts on the go. Furthermore, many Excel receipt makers are available as free templates, making them a cost-effective solution for those looking to keep their business expenses low. The templates are simple to use and require no special technical skills, which means anyone can create professional-looking receipts without having to hire an accountant or designer.

However, one limitation of using an Excel receipt maker is that it requires basic knowledge of Excel. While the templates are user-friendly, individuals who are not familiar with Excel may find it challenging to navigate the software or customize the receipt templates. In such cases, it’s essential to ensure that the receipt template is easy to use and understand, especially if you’re dealing with a large number of transactions or need to frequently modify the receipt format.

Additionally, while Excel receipts are convenient for businesses that rely on manual record-keeping, larger organizations may require more advanced invoicing or accounting software to handle complex transactions, track payment statuses, and generate reports. Excel receipt makers, while useful, may not have the advanced features needed for large-scale operations, such as automated reminders for overdue payments or integration with payment processing systems. For these types of businesses, investing in dedicated accounting or invoicing software might be a better option.

In conclusion, an Excel receipt maker is a powerful tool for creating customized, professional receipts that streamline the process of transaction documentation. It offers several benefits, including ease of use, customizability, and the ability to maintain a digital record of all transactions. While it may not be the most advanced solution for larger organizations, it is an ideal option for small businesses, freelancers, or individuals who need a simple and cost-effective way to manage receipts. By leveraging the functionality of Excel, businesses can ensure that their transactions are accurately documented and easily accessible for future reference.

What Are Invoice Templates?

Invoice templates are invaluable tools for businesses and individuals alike, offering a structured and efficient way to create professional invoices without having to start from scratch. These templates are pre-designed outlines that streamline the invoicing process, allowing users to quickly input relevant details such as company information, client details, products or services provided, and payment terms. Available in a variety of formats such as Excel, Word, Google Sheets, and Google Docs, these templates offer versatility, enabling users to choose the format that best suits their needs and preferences. Once the necessary information is entered, the invoice can be saved in the desired format—whether it’s Word, Excel, or PDF—and sent directly to the client, ensuring a seamless and professional transaction process.

Using an invoice template offers several key advantages, especially when compared to creating invoices from scratch. For businesses, invoicing can become a repetitive and time-consuming task, particularly for those with frequent billing cycles or numerous clients. Invoice templates help automate the process by providing a consistent structure for each transaction. Rather than starting with a blank page, users simply fill in the appropriate fields, such as the company name, address, contact details, and tax information, as well as the customer’s name, contact details, products or services sold, and pricing information. This speeds up the invoicing process, reducing the time spent on administrative tasks and minimizing the likelihood of errors.

The customization of invoice templates is another significant advantage. Many templates are highly flexible, allowing users to tailor the design to reflect their company’s branding. This includes adjusting colors, fonts, and layout to create a cohesive, professional appearance that matches the company’s identity. Adding a logo to the invoice is also possible, which further enhances the document’s professional look and ensures it aligns with the company’s visual brand. This customization ability makes templates particularly useful for small businesses, freelancers, and entrepreneurs who want to project a professional image without the need for graphic design skills.

In addition to these aesthetic benefits, invoice templates are also highly functional. Most templates are designed with built-in fields and formulas that automatically calculate totals, taxes, and discounts. This reduces the risk of human error and ensures accuracy in billing, which is particularly important for maintaining trust and professionalism with clients. Whether calculating sales tax, applying a discount, or simply adding up the total cost of goods or services, these templates handle the heavy lifting, allowing users to focus on other aspects of their business.

Moreover, invoice templates are a great solution for businesses looking to maintain a digital record of their transactions. By saving invoices digitally, either in the cloud or on local storage, businesses can easily access past invoices, track payments, and organize their financial records. This is particularly beneficial for tax filing, as it simplifies the process of gathering all necessary documentation. Having digital invoices also eliminates the risk of losing physical paperwork and makes it easy to retrieve and send copies of invoices if needed.

Free invoice templates are readily available online, offering a wide range of options for different business needs. Some templates are specifically designed for particular industries, while others are more general. These free options can be found in various formats such as blank invoice templates for Excel and Word, Google Docs and Google Sheets templates, and even printable PDF versions. For businesses looking to keep costs low, these free templates are an excellent choice, providing a cost-effective solution for invoicing without compromising on quality.

However, while free invoice templates are a great starting point for many businesses, they may not offer the advanced features found in dedicated invoicing software. For example, invoice templates typically do not offer features like automated payment reminders, tracking overdue invoices, or saving customer details for future invoices. These are features that might be needed by larger businesses or those with more complex invoicing needs. In such cases, investing in invoicing software could provide additional functionality that streamlines the invoicing and payment collection process.

In conclusion, invoice templates are an essential tool for businesses of all sizes, offering a quick and efficient way to generate professional invoices. They help save time, reduce errors, and improve the overall efficiency of financial operations. Whether used for occasional transactions or frequent billing cycles, these templates provide a reliable solution that ensures consistent and accurate invoicing. By offering customizable designs, built-in calculations, and digital record-keeping capabilities, invoice templates are an invaluable resource for any business looking to maintain a professional image and streamline their invoicing process.

How to Generate an Invoice in Excel Using a Template

To generate an invoice using an Excel template, simply follow these steps:

- Download the Template: Choose a template that fits your business needs.

- Add Business Details: Fill in your business name, address, and contact information so your client knows how to reach you.

- Add Client’s Details: Include the name and address of your client.

- Invoice Number: If this is your first invoice, start with a number like 1, 100, or 1001. Subsequent invoices should follow the numbering sequence.

- Set Invoice and Due Dates: The invoice date is typically the current date, and the due date could be within 14, 30, or other terms you set.

- Product or Service Details: Enter the items or services provided, their price, quantity, tax rates, and the subtotal. The template will automatically calculate the total, including taxes.

- Payment Details: Provide your bank account, PayPal, Google Pay, or QR code for payment options. Don’t forget to add any terms and conditions.

- Export and Send: Once your invoice is complete, export it as a PDF and attach it to an email or print it for mailing.

A key tip: Always remember to add your logo for a professional look. You can also customize the invoice template to match your brand’s colors and fonts.

What Is an Invoice Generator?

An invoice generator is a convenient online tool that allows businesses and freelancers to create professional invoices quickly and efficiently, directly in their web browser. The primary appeal of using an invoice generator lies in its simplicity and speed. By entering essential details such as business name, client information, products or services sold, pricing, and payment terms, users can generate an invoice within minutes. Once the necessary fields are filled, the tool automatically formats the document, ensuring that it meets professional standards, and provides the option to download the completed invoice in a PDF format. This makes it easy to email the invoice directly to clients, helping businesses streamline their invoicing process.

One of the main advantages of using an invoice generator is its accessibility. Since these tools are web-based, there is no need to install any additional software on your device. Whether you are working from a desktop, laptop, or mobile device, you can create and send invoices on the go. This level of accessibility is especially useful for freelancers, small business owners, or anyone who needs to generate invoices while traveling or working remotely. The convenience of being able to create an invoice in minutes from virtually anywhere makes an invoice generator an invaluable tool for businesses that need a fast and flexible solution for their invoicing needs.

Another significant benefit of using an invoice generator is the ease of use. Most online tools are designed to be intuitive and user-friendly, with clear prompts that guide you through the process of creating an invoice. Unlike traditional invoicing methods, where users may need to spend time formatting the document and calculating totals manually, an invoice generator handles these tasks automatically. After entering the required details, such as the client’s name, the items or services provided, and the amount due, the tool will calculate the subtotal, apply any applicable tax, and generate a total. This not only reduces the risk of errors but also saves time, ensuring that the invoice is ready for distribution without any hassle.

Additionally, many invoice generators offer customizable templates, allowing businesses to personalize their invoices to match their brand identity. Users can choose from a variety of pre-designed templates, which can be customized with their business logo, colors, and fonts. This level of customization ensures that the invoices you send reflect your professional image and create a cohesive brand experience for your clients. Whether you are a freelancer, a small business owner, or a larger company, having a well-designed, branded invoice can enhance your professionalism and help you stand out from competitors.

Invoice generators also offer features that make it easier for businesses to manage their invoicing process. Many tools allow users to save client information, such as names, addresses, and payment terms, making it faster to generate invoices for repeat customers. Additionally, some invoice generators offer features like invoice tracking, which allows businesses to monitor the status of their invoices and follow up with clients if payments are overdue. This feature is especially useful for businesses that need to ensure timely payments and maintain a steady cash flow.

Furthermore, the invoices created with an invoice generator are typically in a PDF format, which ensures that they are both professional-looking and universally accessible. PDFs are easy to open on any device, making it simple for clients to view, print, or save their invoices. The PDF format also helps maintain the integrity of the invoice, preserving the layout, fonts, and branding elements regardless of the device or software the recipient uses. This ensures that your invoices will look just as professional when they are opened by your client as they did when you first created them.

However, while invoice generators provide an easy solution for creating and sending invoices, they may not offer the advanced features that some businesses require. For instance, larger businesses or those with complex invoicing needs may need additional functionalities, such as integration with accounting software, the ability to track payments automatically, or automated reminders for overdue invoices. For these businesses, more advanced invoicing software might be necessary.

In conclusion, an invoice generator is a fast, convenient, and cost-effective solution for creating professional invoices. With its user-friendly interface, customizable templates, and automatic calculations, it simplifies the invoicing process for businesses and freelancers alike. While it may lack some advanced features, the ease of use and accessibility of an invoice generator make it an ideal tool for small businesses, independent contractors, and anyone who needs to create invoices quickly and efficiently. Whether you are a freelancer managing multiple clients or a small business owner looking to streamline your invoicing, an invoice generator provides an excellent solution to ensure you get paid promptly and professionally.

How to Use an Invoice Generator

To create an invoice using an online generator, follow these steps:

- Enter Business and Customer Details: Provide your business and client information.

- Set the Due Date: Choose when the payment is due, whether it’s within 14 days or any other time frame.

- Add Products or Services: List the items or services provided along with their prices, tax rates, and any discounts.

- Select Currency: Choose the appropriate currency for the transaction.

- Include Payment Information: Add payment details, such as your bank account or payment links.

- Download and Send: After filling in all necessary details, download the PDF invoice and send it to your client.

Invoice Generator, Excel Template, or Invoicing Software?

Choosing between an Excel template, invoice generator, or invoicing software depends on your specific needs:

- Invoice Generator: Best for quick and simple invoice creation directly in your browser. Ideal for creating invoices on the go.

- Excel Template: Suitable for users who prefer working offline and using Excel’s functionality to customize invoices.

- Invoicing Software: If you’re looking for advanced features like tracking sales, storing client information, or automated reminders for overdue invoices, invoicing software is the best choice. It provides more control and ease of use, especially if you need to streamline your invoicing process.

The Benefits of Free Invoice Software

Free invoicing software is an invaluable tool for businesses of all sizes, offering an efficient and cost-effective way to manage invoicing while saving time and reducing administrative burdens. This software combines the benefits of both invoice templates and online invoice generators, making it easier for users to create, manage, and track invoices. What sets free invoicing software apart from traditional methods, such as Excel templates or basic online generators, is its ability to provide additional features like automatic invoice tracking, client management, and overdue payment notifications, all within a single platform.

One of the standout features of free invoicing software is automatic invoice tracking. Once an invoice is generated and sent to a client, the software tracks its status in real-time, providing you with an easy way to monitor whether the invoice has been paid, is still pending, or is overdue. This eliminates the need for manual follow-up, reducing the chances of human error and ensuring that no invoice slips through the cracks. For businesses with multiple clients and frequent billing cycles, this feature is a game-changer, helping to maintain smooth cash flow and ensuring that payments are collected on time.

In addition to invoice tracking, free invoicing software often includes client management tools that allow you to store important client information such as names, contact details, payment history, and special billing terms. By having all of this information readily available within the software, you can easily generate future invoices for repeat clients without needing to manually input their details each time. This not only speeds up the invoicing process but also reduces the likelihood of mistakes, as you’re working with up-to-date information that’s already saved within the system. Client management tools can also help you keep track of client preferences and specific invoicing requests, further streamlining your billing process.

Another valuable feature of free invoicing software is the ability to set up overdue payment notifications. Late payments can be a major challenge for businesses, especially small businesses and freelancers who rely on timely payments to maintain healthy cash flow. With free invoicing software, you can automatically send reminders to clients when an invoice is nearing its due date or when it has become overdue. This feature can significantly reduce the administrative work involved in chasing up payments and improve the chances of getting paid promptly. It’s a simple yet effective way to ensure that your business doesn’t face financial strain due to unpaid invoices.

Free invoicing software also typically includes customizable invoice templates that allow you to create professional, branded invoices in just a few clicks. These templates can often be tailored to match your company’s logo, colors, and fonts, providing a cohesive and polished appearance that helps reinforce your brand identity. Additionally, many software tools allow you to include other essential details on your invoices, such as tax rates, payment terms, and due dates, ensuring that each invoice meets legal and business requirements.

Furthermore, since many free invoicing software options are cloud-based, they offer the convenience of access from any device with an internet connection. This means that whether you are at the office, at home, or on the go, you can create, send, and track invoices with ease. Cloud-based systems also offer the added benefit of securely storing your invoices and client information, ensuring that your data is protected and easily retrievable if needed.

For businesses operating with limited resources, free invoicing software offers a low-cost solution that simplifies the invoicing process without sacrificing functionality. Many free options provide sufficient features to meet the needs of small businesses, freelancers, and startups, allowing them to automate and streamline invoicing without incurring additional expenses. As businesses grow, some free invoicing software also offers paid plans with advanced features, enabling them to scale their invoicing systems as their needs evolve.

In conclusion, free invoicing software is an indispensable tool for businesses looking to save time, reduce manual work, and ensure prompt payments. By combining the simplicity of invoice templates and generators with additional features like invoice tracking, client management, and overdue payment notifications, this software provides an all-in-one solution for managing invoices efficiently. Whether you are a freelancer or a small business owner, using free invoicing software can help you stay organized, maintain professional standards, and focus on growing your business. The time-saving benefits and ease of use make it an excellent option for businesses looking to streamline their invoicing process without the need for costly software solutions.

Conclusion: Which Should You Choose?

Choosing the right invoicing solution depends on several factors, including your level of comfort with different tools, the nature of your business, and the features you prioritize. Whether you’re a freelancer, a small business owner, or running a larger operation, your invoicing needs may vary, and the right solution can help streamline your operations while ensuring professional and timely payments.

If you are someone who is familiar with Excel and prefers working with spreadsheets, then an invoice template might be the best choice for you. Excel invoice templates allow for flexibility and customization, enabling you to create invoices that match your business’s brand. They are also a good option for businesses that don’t need advanced features but simply want a structured, manual way of managing their invoicing. Templates are ideal for those who already have the necessary software and don’t want to spend time learning a new tool. Since you’re creating invoices offline, there is no need for an internet connection, making it a reliable solution even without access to online resources.

However, if your business requires more flexibility and you need to create invoices on the go, an online invoice generator might be the perfect fit. Invoice generators provide a fast, web-based solution that allows you to create and send invoices directly from your browser. These tools often have mobile-friendly versions, allowing you to create and manage invoices from your phone or tablet. This feature is particularly useful for freelancers, service providers, or anyone who works remotely and needs to invoice clients quickly and efficiently, no matter where they are. With online invoice generators, there’s no need for specialized software, and you don’t have to worry about saving files or using a specific device to create invoices.

If your business involves more complex invoicing requirements, such as automated reminders, payment tracking, or client management, free invoicing software offers the most comprehensive solution. Unlike invoice templates or basic online generators, invoicing software typically includes advanced features that make it easier to manage multiple clients and track overdue payments. Many free invoicing tools also allow you to store client information, which means you can quickly generate invoices for repeat customers without needing to manually input their details each time. This can save time and reduce the likelihood of errors. Furthermore, some invoicing software tools offer features like integration with accounting software, which can help automate financial recordkeeping and streamline your business’s financial operations.

Choosing invoicing software with automated reminders can also help ensure timely payments. Clients sometimes forget about outstanding invoices, which can lead to delays in cash flow. With invoicing software, you can set up automatic notifications to remind clients about upcoming payment due dates or overdue invoices. This automated feature eliminates the need for manual follow-ups, ensuring that you don’t miss any payments and allowing you to focus on other aspects of your business. Additionally, many invoicing software platforms offer customizable invoice templates, so you can ensure that every invoice aligns with your business’s branding and professional standards.

For businesses that also need receipts, a receipt maker or receipt template can complement your invoicing system. A receipt maker allows you to quickly create and send receipts for payments received, which is important for maintaining accurate financial records. If your business involves rental services, a rent receipt generator can be particularly useful. Rent receipt generators simplify the process by automatically including essential details such as rental property information, payment dates, amounts, and tenant details. This can save you time while ensuring that your tenants receive accurate and timely receipts for their payments.

By considering your business’s specific needs, the level of customization required, and your desired features, you can choose the invoicing tool that best suits your requirements. For those who value simplicity and efficiency, an invoice template might be sufficient. For businesses that need more flexibility or work on the go, an online invoice generator is an excellent choice. And for businesses that require more advanced tracking, reminders, and client management, free invoicing software offers the most comprehensive and time-saving solution. With the right invoicing tool, you can ensure that your financial transactions are efficient, professional, and streamlined, allowing you to focus on what matters most—growing your business.